Who’s to blame for soaring gold imports? Traditional Indian obsession with the “barbaric relic?” Or speculators?

Raghuram Rajan’s Economic Survey for 2012-13 seems to suggest that the finger needs to be pointed at policy failure. In short, government itself.

The survey says that the reason for increasing demand for gold is higher inflation which is resulting in poor real returns from other financial instruments.

It pointed out that gold imports are positively correlated to inflation. “High inflation reduces the return on other financial instruments. This is reflected in the negative correlation between rising imports and falling real rates,” the survey has said.

[caption id=“attachment_642613” align=“alignleft” width=“380”] The survey says that the reason for increasing demand for gold is higher inflation which is resulting in poor real returns from other financial instruments.[/caption]

The survey says that the reason for increasing demand for gold is higher inflation which is resulting in poor real returns from other financial instruments.[/caption]

It has also put the blame for higher inflation squarely on the government’s fiscal profligacy during the post-Lehman crisis.

According to the survey, the primary reason for the present slowdown in the economy is the monetary and fiscal stimulus provided after the crisis at large.

“Final consumption grew at an average of over 8 per cent annually between 2009-10 and 2011-12. The result was strong inflation and a powerful monetary response that also slowed consumption demand,” the survey said.

So, the key reason behind the high inflation, which is pushing up gold imports, is the government’s own policy mis-steps.

The returns from gold have also been mind-boggling. According to the survey, annual average return from gold during the April 2007-March 2012 period was 23.7 percent as against a measly 7.3 percent on the Nifty and 8.2 percent on savings deposits.

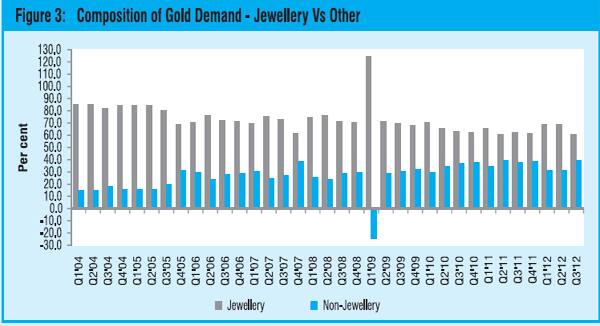

This has pushed up the demand for gold as an investment destination. The survey notes that in the last quarter, non-jewellery, or investment, demand constituted 40 percent of the total demand for gold.

“With limited access to financial instruments, especially in the rural areas, gold and silver are popular savings instruments,” the survey said.

[caption id=“attachment_641970” align=“alignleft” width=“600”] Demand for gold as investment tool has been increasing over time. Source: India’s economic survey[/caption]

Demand for gold as investment tool has been increasing over time. Source: India’s economic survey[/caption]

Does the survey see the trend changing anytime soon?

No, because even though real rates have started rising, they are barely in positive territory, the survey points out. This means gold’s attraction is only going to increase.

“Given soaring energy and transportation needs, since there seems to be little we can do to temper oil imports, gold is the component that needs to be contained to bring the CAD (current account deficit) back to a comfort zone,” the survey said.

This is like an open invitation to the finance ministry to hit gold buyers with more duties in the budget.

)