The ongoing polls have not only caused project delays but also pulled down sales ofresidential unitsin big cities as election financing isbleeding already cash-strapped real estate developers dry.

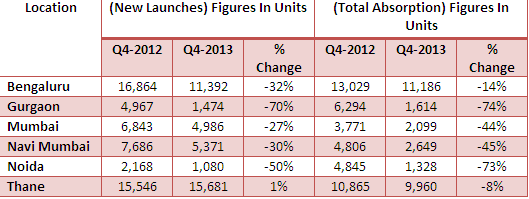

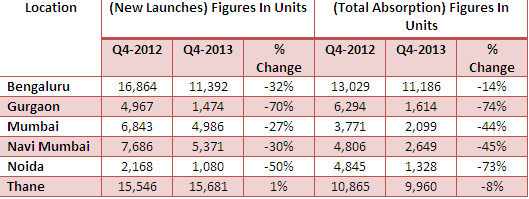

Data by property research firm PropEquity shows Gurgaon, Noida and Mumbai have seen the steepest fall in not only new project launches but also in absorption (the rate at which available homes are sold in a specific real estate market) in the last one year.

The volume of residential units sold is down 74 percent in Gurgaon, 73 percent in Noida, 44 percent in Mumbai and 45 percent in Navi Mumbai in the fourth quarter of 2013 from the year-ago figure.

Price escalation seems to be one of the primary reasons for the sales downtrend.

Meanwhile, new projects have been put on hold too.Gurgaon has seen the largest 70 percent drop in project launches in the last one year. From 4,967 units, the launches are now down to just 1,474 units. Even in Noida, which is largely seen as an investor-driven market, launches are down by half. Ironically,m utual dependence between builders and politicians is most acute in areas where land is in high demand, such as these fast-growing regions near New Delhi.

Mumbai is comparatively better with a 27 percent drop, while Bangalore too has seen a 32 percent drop in launches.

[caption id=“attachment_82027” align=“aligncenter” width=“529”]  Data: PropEquity[/caption]

•All the data points discussed in the above table refer to primary market only

• Above residential data set comprises residential apartments only

• Above residential data is representative of organised real estate developers only

Another study by 99acres.com showed housing prices declined by an average 8 percent in Delhi-NCR (one of the most sought-after property destinations) in 2013 compared with the year-ago period due to slowdown in property market amid economic and political uncertainties.

According to data collected by the Association for Democratic Reforms (ADR), a whopping 87 percent of political donations between financial years 2004-05 and 2011-12 came from corporates, mainly from trusts and groups of companies, manufacturing and the real estate sector. In fact, while the maximum number of donations was made by the manufacturing sector (595 donations, Rs 99.71 crore), the real estate sector came in at second spot with 340 donations (Rs 24.10 crore). This, however, is only the tip of the iceberg, since real estate generates black money - and politicians will not report the amount of black money to receive.

The rationale behind this election financing is simple. Builders mustfund political candidates to facilitate future opportunities because they have to maintain a relationship with whoever comes to power. Secondly,the amount that most candidates end up spending during campaigning is way more than the legal limit and much of this cash comes from thriving black money market. ( In India, real estate is synonymous with black money.) So during elections, a huge among of this black moneyis pumped by developers into the election campaigns of various parties.

In essence, many of India’s real estate companies are now diverting funds from housing and other projects to election campaign contributions, which is why existing projects are being stalled while new ones are being halted completely. To add to this slowdownthe Reserve Bank of India (RBI) has refused to lower interest rates which has acted as a deterrent for potential home buyers. The central bank has also made conditions for restructuring loans of real estate developers very tough. In such a situation, when the demand for money has been made by politicians, many developers are selling off some part of their inventory at below market rates.

“Many developers who are funding possible candidates are delaying projects due to the lack of liquidity.The timing is certainly bad. Reduced housing absorption has already adversely impacted developers’ liquidity and, in turn, developers’ funding ability. Political commentators also note that certain properties are sold below market rates in order to generate cash for election campaigns. Given this situation, many developers cut down on new launches and focus solely on selling the existing inventory,” said Ramesh Nair, COO - Business, Jones Lang Lasalle India.

Data by JLL shows that Mumbai has an inventory pile-up of close to 48 months, Delhi of 23 months and Bangalore of 25 months.

Does this mean that property prices will come down soon?

It is rather unlikely since election results do not lead to any major price movements. So far, none of the campaigns or manifestoes has outlined a comprehensive proposal for recovery of the real estate market - specifically in terms of providing more housing and managing interest rates. But there is talk in all manifestoes about low-cost housing or providing homes to all. It is not clear how this will impact the realty market, since no details are available on what parties actually intend to do.

Also, given that’s India’s economy continues to remain in free fall ( read more here), people will think twice before lining up to buy property. For working professionals, high inflation will eat into what they can spare for their home EMIs.

)

)

)

)

)

)

)

)

)