So you think consumer inflation has been tamed? Think again.

Experts have already pointed out that despite the slide in headline inflation (consumer prices), core inflation (excluding volatile food and energy prices) remains stubbornly high at 7.9 percent. ( Read more here .)Consumer price index inflation, meanwhile, slipped to 8.1 percent in February.

A Firstbiz story has already highlighted a list of reasons why the RBI can’t cut rates ; indeed, it might need to hike them, the story suggests.

Now, here’s another troubling trend that will give the central bank more reason to maintain an aggressive watch on inflation – and refrain from cutting rates.

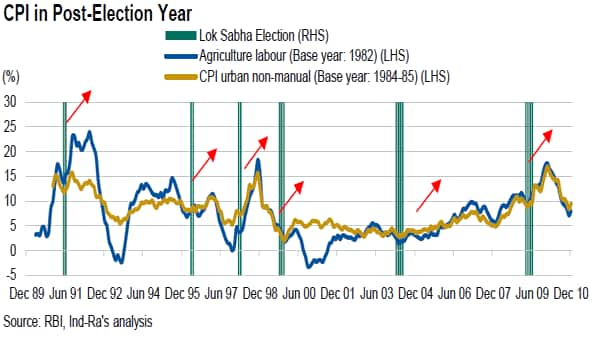

According to a recent report by India Ratings and Research, a Fitch company, in the past six general elections, the “post-election period has always observed a spike in CPI. Thus, doubts remain whether the recently observed cooling off of CPI will continue.

Indeed, the report also notes that historically, consumer inflation tends to fall two to three months before the elections.However, after the elections, inflation climbs back again.

[caption id=“attachment_80896” align=“aligncenter” width=“600”]

Post-Election CPI Spike[/caption]

Post-Election CPI Spike[/caption]

That trend looks likely to continue.The recent decline in consumer inflation has been largely credited to falling food prices. But the good news on that front might end soon. As the RBI notes in its policy document, “Looking ahead, vegetable prices have entered their seasonal trough and further softening is unlikely.”

That suggests inflation isn’t likely to plunge dramatically from here on, given the important role of food prices in consumer price inflation. In addition, there are still a fair number of threats to inflation lurking on the horizon - from the El Nino weather phenomenon to the impact of the new government’s economic policies.

So, all those secret wishes about large rate cuts later in the year, you may as well kill them now.

)