Goldman Sachs upgraded Indian shares to “overweight” from “marketweight” and raised its target on Nifty to 7,600, citing reduced external vulnerabilities, including a narrowing current account deficit, and potential for gains ahead of elections that conclude in May.

The Nifty earlier today rose as much as 1.1 percent to a record high of 6,574.95. Markets were closed on Monday for a public holiday.

Here are four reasons why the brokerage is upbeat on India:

_1) Better CAD, stable rupee:_Current macro adjustments have reduced India’s external vulnerability,relieving pressure on the current accounts, increasing foreign exchange reserves andstabilising the rupee. India’strade balance has improved in recent months asgold demand remains subdued, and export growth has remained positive. Goldman Sachs’ economists expect the current account deficit to fall below 2 percent of the GDP in FY14, from 4.8 percent in FY13.

2)GDP growth expected to pick up in second quarter of FY14:Goldman Sachs expects India’s GDP growth to bottom out in the first quarter of fiscal 2014 and gradually pick up by the second quarter onbetter-than-expected PMI (HSBC’s purchasing manager’s index) readings and a moderation in inflation.

“In India, large-scale infrastructure and industrial projects seem to be progressing well after initial delays,” it said in a report.

The financial firm favours cyclicals over defensives because of expectations of an improving economy and a bottoming out of earnings, according to the report dated March 14.

It also advised investors to focus on potential election beneficiaries in these markets.It upgraded auto stocks to “overweight”, while retaining the same rating on IT and energy stocks.

Goldman said Oil and Natural Gas Corp , Coal India , NTPC and Bharat Petroleum Corp and other public sector companies could be key election beneficiaries.Among private sector shares, ICICI Bank, Larsen and Toubro, UltraTech Cement, JSW Steel, Indusind Bank and Voltas were seen by Goldman as gaining from elections.

View the full list of recommended stocks below:

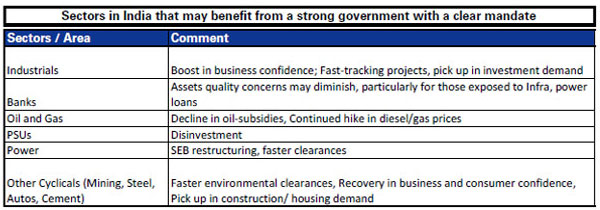

_3) Elections expected to be a catalyst for reforms:_The upcoming Lok Sabha elections will have animportant bearing on the policy choices and the progress of structural reforms,which is particularly important for a pick-up in investment activity and the overallgrowth cycle, said Goldman Sachs.

Going by the historical evidence, equity markets have always traded up three months prior to elections. For instance, the Nifty has rallied and outperformed the broader regional index (MXAPJ) in four of the past five elections since 1996 and averaged 12% returns, three months before the election results, it said.

Explaining the trade patterns of equity markets in the run-up to elections, the report states that cyclicals like autos, banks and industrials usually rally with foreign inflows being supportive of their performance. However, it warns that volatility tends to rise during this period as well.

The report illustrates this by citing how the Nifty gained 28 percent since the beginning of 2009 elections and rose18 percent the day after the election results but lost 24 percent during 2004 elections and fell 12 percent afterthe results.

- _Foreign flows have generally been supportive in the run-up to recent elections:_In the case of India, both during the 2004 and 2009 elections, foreign institutions net bought US$3-4 bn of equities in the three months heading into the elections.

The report states that “…key risks includea) any renewed concerns on EM (although both look better placed thanother EM deficit countries); b) an indecisive result in elections that couldexacerbate uncertainty and trigger outflows; and c) a faltering recovery.”

With inputs from Reuters

)