Washington DC: Federal Reserve Chairman Ben Bernanke on Tuesday acknowledged the economy has slowed but offered no hint about the US central bank considering any more stimulus to accelerate growth.

He also warned members of Congress who might be planning aggressive budget cuts that they have the potential to derail the recovery if cuts in government spending take hold too soon.“A sharp fiscal consolidation focused on the very near term could be self-defeating if it were to undercut the still-fragile recovery,” he said. Hecalled for a long-term plan for a sustainable fiscal path.

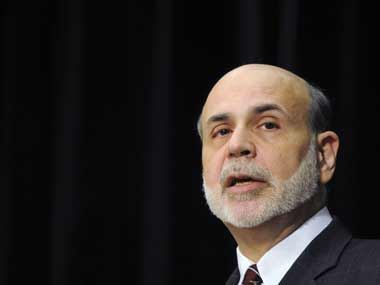

[caption id=“attachment_22088” align=“alignleft” width=“380” caption=“Fed chairman said that while he expects the economy to strengthen in the second half of the year, the job market bears close monitoring.Reuters”]

[/caption]

[/caption]

A recent spate of weak economic data, capped by Friday’s report showing anemic job creation last month, had renewed speculation the Fed might again come to the economy’s aid.Bernanke gave no such indication but did say the recovery was fragile enough to warrant keeping in place the extraordinary monetary support the Fed has already provided.

Speaking to a banking conference, the Fed chairman said that while he expects the economy to strengthen in the second half of the year, the job market bears close monitoring.“The economy is still producing at levels well below its potential,” he said. “Consequently, accommodative monetary policies are still needed.”

Richard Gilhooly, an interest rate strategist at TD Securities in New York, called the speech “pretty downbeat”.“It means that the Fed’s on hold for longer,” he said.

Stocks closed lower after Bernanke’s sober assessment, while longer-term bonds erased losses.Bernanke repeated his view that a spike in U S inflation, while worrisome, should prove fleeting as commodity prices moderate. In addition, weak wage growth and stable inflation expectations should help keep prices down, he said.

All tapped out?

The central bank has already slashed overnight interest rates to near zero and purchased more than $2 trillion in government bonds to pull the economy from a deep recession and spur a recovery.

With the central bank’s balance sheet already bloated, officials have suggested there would be a high bar for any further Fed easing. The Fed’s current $600 billion round of government bond buying, known as QE2, is due to end this month.

Sharp criticism in the wake of QE2 is one factor likely to make policymakers reluctant to push the limits of unconventional policy.“QE3 is still not an option right now, more because of the political ramifications,” said Kathy Lien, director of currency research at GFT in New York. “We need to see much more significant deterioration in the economy and consistent weakness in non-farm payrolls before that can happen.”

In a Reuters poll of U S primary dealer banks conducted after the employment data, analysts saw only a 10% chance for more government bond purchases by the Fed. They also pushed back the timing of an eventual rate hike further into 2012.

Reuters

)