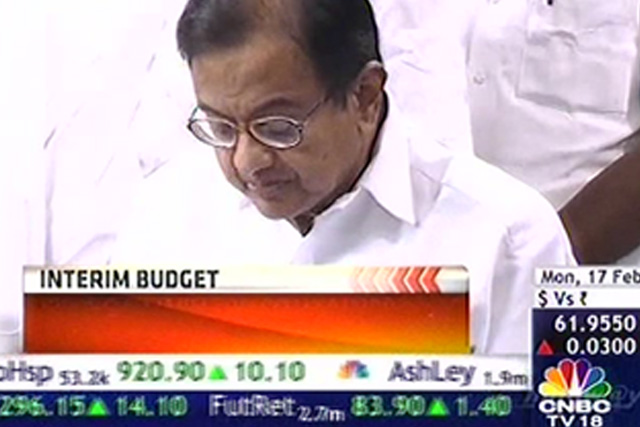

So where does India stand at the end of P Chidambaram’s vote-on-account budget speech?

Certainly better than before, as the worst in terms of populist giveaways did not happen. But we are not any better placed than before. Thankfully, we saw no special pyrotechnics from the Seemandhra crowd, beyond the general din.

So Chidambaram has given us a shorter speech, with the usual playing to the gallery, some pandering to favoured votebanks, and some much-needed sops for beleaguered sectors. But the most important point to make is simple: since there were no new taxes and only giveaways here and there, the next government will have to raise taxes sooner or later.

Here are the six main takeouts from Chidambaram’s interim budget:

First, the fiscal deficit number of 4.6 percent is better than the red line of 4.8 percent that was promised, but it is unreal, since it involves rolling over Rs 35,000 crore of fuel subsidies to the next year. And there could be more such accounting surprises once we read the fineprint.

Second, real fiscal correction is far, far away, as the revenue deficit is still at 3.3 percent - same as in last year’s budget. Next year, the revenue deficit will be 3 percent - not significantly lower. And Chidambaram does not have to live up to that. The correction thus happened in plan and capital spending - which are the parts that drive growth. In short, Chidambaram has eaten up the growth-inducing expenses, while sparing the wasteful ones like subsidies. Chidambaram pulled the same trick as last year - with plan spending for next year being the same as last year’s target - which was missed by a mile.

[caption id=“attachment_76586” align=“alignleft” width=“380”]  The government has just transferred its debt to the next government. Reuters[/caption]

Third, the excise cuts on capital goods - from 12 percent to 10 percent - and the cuts on bikes, cars and SUVs are needed, and thus will be applauded even in an election year. However, it is not clear if the revenue losses under these heads have probably not been fully accounted for. Since diesel prices have to continue rising to reduce oil subsidies next year, one has to see if the cuts will boost growth - or whether the auto majors will swallow the cuts to improve bottomlines.

Fourth, the subsidy bill of Rs 2,46,000 crore is likely to be another underestimate - for it is almost the same as this year, when Rs 35,000 crore has been rolled over. It is unlikely the food subsidy is going to be any lower when the food security bill kicks in only from the next financial year.

Fifth, the populist parts of the budget - like the announcement of one-rank-one-pension for the army, or more money for the minorities and women - are likely to do less damage than the time-bombs like the Seventh Finance Commission - which has been announced earlier. The land acquisition issues and costs under the new Land Bill will continue to haunt the chances of a quick recovery for some time to come.

Sixth, Chidambaram harped on the need to cut interest rates in order to revive growth and claimed some inflation is unavoidable in a growing economy. It is unlikely that RBI Governor Raghuram Rajan is on the same page as him on this. Thus, the battle between North Block and Mint Street not only continues, but will spill over to the next government as well.

)

)

)

)

)

)

)

)

)