The markets can remain irrational, longer than you can stay solvent, said John Maynard Keynes. “But what about the stock market?” is a question that one gets often asked while talking about the state of the Indian economy these days. The economy is in a state of a slowdown. A whole host of high-frequency economic indicators, everything from car sales to volume growth of FMCG companies to bank lending to industry, seem to suggest that. [caption id=“attachment_4237439” align=“alignleft” width=“380”]

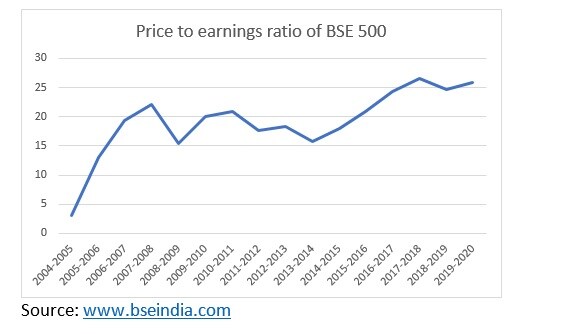

Representational image. Getty.[/caption] The National Council of Applied Economic Research recently said that the Indian economy will grow by 4.9 percent during this financial year. In August 2019, it had forecast economic growth of 6.2 percent. Other than NCAER, Nomura Financial Advisory and Securities, has cut India’s GDP Growth forecast for 2019-2020 to 4.9 percent, against the earlier 6 percent. Despite all this, the BSE Sensex, India’s most popular stock market index, continues to remain on a strong footing. As I write this, on the morning of 19 November 2019, the Sensex is quoting at around 40,477 points. The question that one gets often asked is if the economy is in such a bad shape, why is the stock market not reflecting that. Why has the BSE Sensex continued to rise? Take a look at Figure 1. It basically plots the price to earnings ratio of the stocks that make up for the BSE Sensex. What does Figure 1 tell us? The price to earnings ratio of the Sensex stocks is at 27.4 in 2019-20. This basically means that investors during this year have been ready to pay Rs 27.4 as price for every rupee of earning of Sensex stocks. As is visible, the price to earnings ratio of the BSE Sensex has been at its highest level during the current financial year. This means that investors have been ready to pay more for every rupee of company earnings than they have been in the past. When I brought out this anomaly recently on Twitter, I was told that investors are paying the price they are for stocks, simply because they believe that in the future the company earnings will go up. One look at the graph tells us why this is a very dicey assumption to make. The price-to-earnings ratio of the Sensex stocks has been going up since 2012-2013. Every year, it has grown to a higher level. What does this tell us? It tells us that on the whole, the stock prices have grown much faster than the earnings of the companies they represent. With every passing year, the earnings have disappointed but the Sensex has continued to rise, and the gap between earnings and price has only gone up. What does this tell us? It tells us that at some level the stock market investors are living in perpetual hope of earnings growth catching up with stock prices, one day, someday. This doesn’t inspire much confidence. Now take a look at Figure 2, which basically plots the price-to-earnings ratio of stocks that constitute the BSE 500 index, a much broader than the BSE Sensex.

The price-to-earnings ratio of the stocks that constitute the BSE 500 index, during the course of this financial year, has been at 25.9. But it was at a higher level of 26.6 in 2017-18. What does this tell us? It tells us clearly that while investors have been ready to pay higher prices for Sensex stocks, despite the lack of earnings growth, the same isn’t true about a bulk of the stocks that comprise BSE 500. The BSE Sensex comprises of the top 30 stocks in the stock market. They are commonly referred to as large-cap stocks. It’s some of these large-cap stocks which have been driving the Sensex up. What is true about the Sensex isn’t necessarily true about other indices like BSE 500.

The BSE 500 reached a peak of 15,937.92 points in 2018-2019. This year, it has reached a peak of 15,742.11 points. The Sensex on the other hand reached an all-time high of 40,749.33 points. It had peaked at 38,989.65 points in 2018-19.

The larger point here is that a very small section of the stock market has been driving up the overall stock market. A bulk of the investor money is being invested in these stocks. The question is where is this money coming from? A very low-interest rate scenario prevails in large parts of the Western world. The Federal Reserve of the United States has been cutting interest rates after many years. Interest rates are negative in large parts of Europe. This has essentially led to foreign investors investing Rs 81,822 crore in the stock market during 2019, the highest since 2014. Of course, the foreign investors have been coming to India in search of higher returns and are betting on the fact that someday the earnings growth of companies will catch up, and for that they are willing to pay a premium as of now. Over and above this, the inflow of money through the systematic investment plan (SIP) route have remained strong during the course of the year. During 2019-20, a total of Rs 57,607 crore has been invested in stocks through this route. The Business Standard recently reported that the profit of corporate India for the period July to September 2019, was at a fifteen-year low. Clearly, these investors are currently paying for hope. What hasn’t helped is that the real estate sector has been down in the dumps and the sector has barely generated returns over the last half a decade. (Vivek Kaul is the author of the Easy Money trilogy)

)

)

)

)

)

)

)

)

)