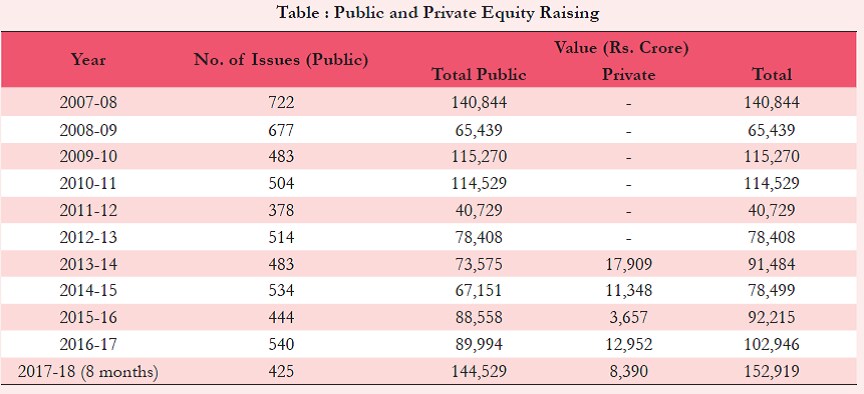

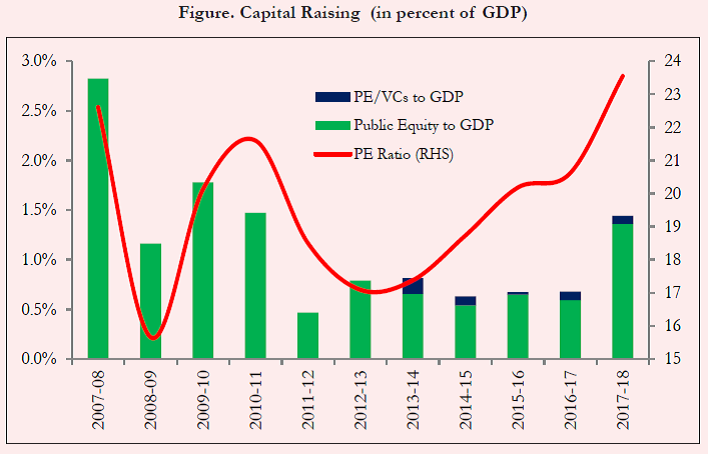

The Economic Survey along with being a good commentary on the state of the economy, also has some very interesting data points. One of the data points in the latest Economic Survey which was released yesterday, concerns the current bull run in the stock market. The law of demand in economics basically states that at lower price levels, the demand is more. But this doesn’t seem to work for the stock market. Money comes pouring into shares, only after they have rallied a bit. This can easily be seen in the kind of money that has been invested into equity mutual funds during the course of this financial year. [caption id=“attachment_4326705” align=“alignleft” width=“380”]  Arvind Subramanian, chief economic advisor. Reuters image[/caption] Equity mutual funds largely invest in shares. Between April and December 2017, Rs 1,25,712 crore has been invested (net investment) into equity mutual funds. This is the highest amount of money that has ever been invested in equity mutual funds, during the course of any financial year, and the current financial year ends only in March 2018. As the overall stock market has gone higher and higher, more money has come into it. Other than mutual funds, public and private offerings of shares by companies, also tend to blossom when the stock market is doing well. It allows companies to sell their shares, at higher prices than they would be able to manage at any other point of time. This incentive motivates more and more companies to sell their shares, which get lapped up by the stock market investors. The following table shows the total amount of money raised by companies through the sale of shares.  Take a look at the above Table. Rs 1,52,919 crore has been raised by firms between April 2017 and November 2017, by selling their shares, during this financial year. In absolute terms, it remains the highest amount of money ever raised by companies by selling shares. The next best year was 2007-2008, when companies managed to raise Rs 1,40,844 crore, through the sale of shares. Nevertheless, this does not take into account the fact that the Indian economy in 2017-2018 is significantly bigger than it was in 2007-2008. Hence, the capacity of the companies to raise money by selling shares, is also significantly more than it was ten years back. How do things stack up when we look at the money raised by companies by selling shares as a proportion to the overall size of the Indian economy (the gross domestic product (GDP)). Take a look at the next Figure.  The ratio of the total amount of money raised by companies through the sale of shares to the gross domestic product, was higher in 2007-2008 than 2017-2018. As a size of the economy, companies raised more money ten years back than they have managed to do during this financial year. As we can see from the above Figure, the total money raised through the sale of shares was around 2.8 percent of the GDP, in 2007-2008. In 2017-2018, this was at around 1.5 per cent. (Look at the left axis of the figure). Given that a lot of money raised through the sale of shares in 2007-2008 and even in 2017-2018, was and has been raised at very high prices (look at the red line in the above figure which maps the price to earnings ratio), many new investors who venture into the stock market very late in the game, tend to be made _bakra_s in the process. They lose money on their investments. The good thing is that during this bull run, the proportion of _bakra_s given the increased size of the Indian economy, has been lower than was the case in 2007-2008. At least, that is what the Economic Survey data seems to suggest. (The writer is the author of India’s Big Government—The Intrusive State and How It is Hurting Us. He tweets @kaul_vivek).

The good thing is that during this bull run, the proportion of bakras given the increased size of the Indian economy, has been lower than was the case in 2007-2008.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)