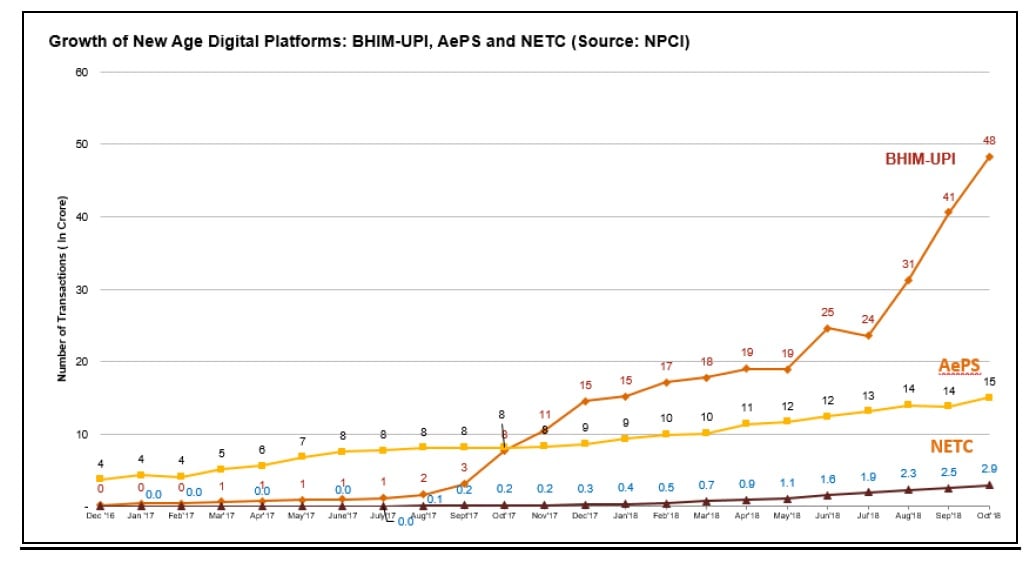

The number of digital payment transactions in India touched 244.81 crore in August 2018, more than three-fold rise from October 2016, underlining the massive adoption of digital payment modes over the last two years, the IT Ministry said on Friday. [caption id=“attachment_4295813” align=“alignleft” width=“380”]  Representational image. AP[/caption] “New payment modes – Bharat Interface for Money-Unified Payments Interface (BHIM-UPI), Aadhaar enabled Payment System (AePS) and National Electronic Toll Collection (NETC) – have transformed digital payment ecosystem by increasing Person to Person (P2P) as well as Person to Merchant (P2M) payments,” the statement by the Ministry of Electronics and Information Technology said. The number of digital payment transactions zoomed 207 percent to 244.81 crore in August 2018 as compared to 79.67 crore in October 2016, it said.  Total value of such transactions, which stood at Rs 108.7 lakh crore in October 2016, increased 88 percent to Rs 204.86 lakh crore in August 2018.

“Over the past two years, digital payment transactions have registered a tremendous growth in India,” the statement added.

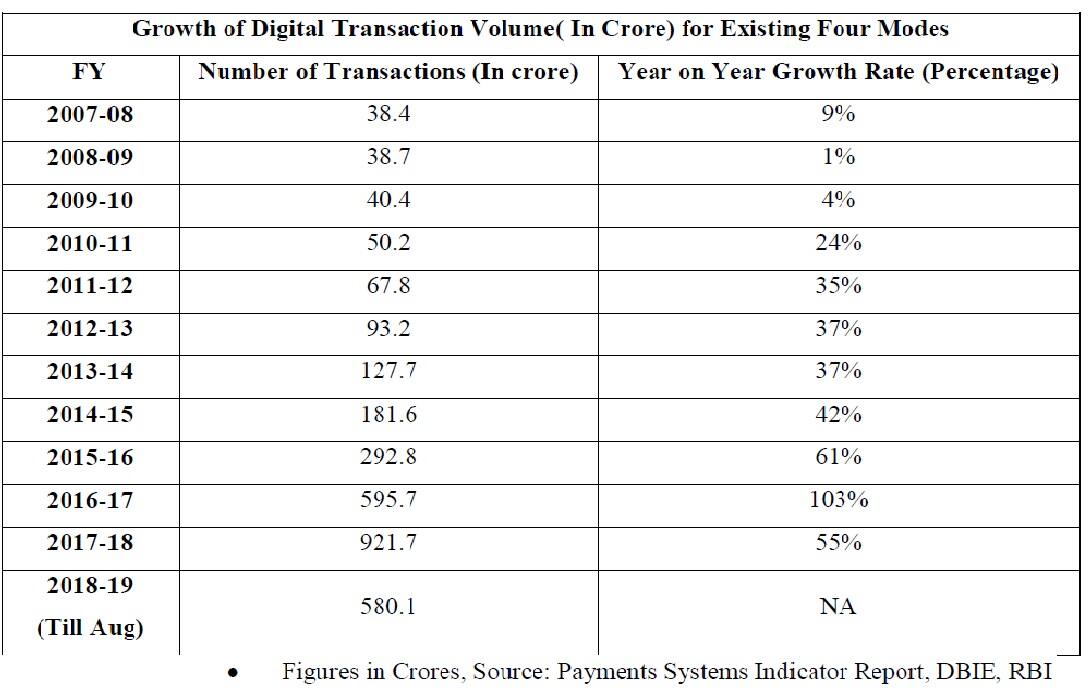

The government had on 8 November 2016, announced a ban on old 500 and 1,000 rupee notes, to curb black money in the system. The move had bolstered adoption of online modes of payment. Outlining the high growth in new payment platforms, the statement noted that in October 2016, the number of transactions on BHIM-UPI was 1.03 lakh with a value of Rs 48 crore – a number that rose to 48.2 crore transactions with a value of Rs 74,978.2 crore in October 2018. The number of transactions on AePS increased to 15.07 crore with a value of Rs 5,893 crore in October 2018, from previous volumes of 2.57 crore with a value of Rs 221 crore in October 2016. The statement pointed out that existing payment modes such as debit cards, credit cards, Immediate Payment Service (IMPS) and Pre Paid Instruments(PPI) have registered substantial growth as well. “With exponential growth, new payment modes have also emerged as a convenient alternative to existing payment modes like debit cards, credit cards, IMPS and PPI. For the first time, the number of monthly transactions under BHIM-UPI during September 2018 surpassed those of any other existing payment mode,” it added. Significant rise in digital payment transactions Total Transactions (Source : RBI, NPCI, Data provided by 56 Banks to MeitY): The number of digital payment transactions in the month of October 2016 was 79.67 crore. This has increased by 207 percent to 244.81 crore in August 2018. The total value of transactions in October 2016 was Rs 108.7 lakh crore which has increased by 88 percent to Rs 204.86 lakh crore in August 2018. Growth of Digital Payment Transactions of Existing Payment Modes - Debit Cards, Credit Card, Immediate Payments System (IMPS) and Pre Paid Instruments (PPI).  High growth of new payments platforms Growth of BHIM-UPI2 (Source: NPCI Website) : In October 2016, the number of transactions on BHIM-UPI was 1.031 lakh with a value of Rs 48 crore, which has increased to 48.236 crore transactions with a value of Rs 74,978.27 crore in October 2018. Growth in AePS3 (Source: Information provided by NPCI on Weekly basis to MeitY) : In October 2016, the number of transactions on AePS was 2.57 crore with a value of Rs 221 crore, which has increased to 15.07 crore transactions with a value of Rs. 5893 crore in October 2018. Growth in Bharat Bill Payment System (BBPS) as Utility Bill Payments4 (Source: Information provided by NPCI on Weekly basis to MeitY) : In October 2016, the number of transactions on BBPS was 11,000 with a value of Rs. 0.035 crore, which has increased to 2.94 crore transactions with a value of Rs 910 crore in October 2018. National e-Toll Collection (NETC): On December 2016, NETC was launched for electronic toll collection at toll plazas using FASTAG. Using NETC, the number of electronic transactions using FASTAG at toll plazas is 2.22 crore with a value of Rs 502 crore in October 2018. --With PTI inputs

)

)

)

)

)

)

)

)

)