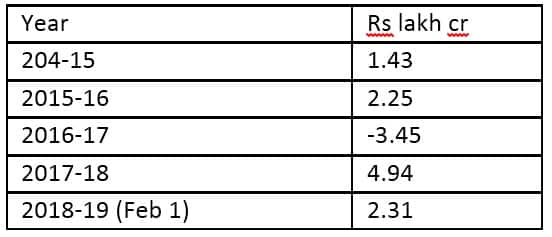

Currency in circulation has peaked at Rs 20.35 lakh crore as of 1 February 2019 which has raised issues on whether this has been driven by the recouping of the informal economy. Demonetisation was introduced for various reasons and as a secondary outcome was to lead to the reduction in the use of cash for transactions. [caption id=“attachment_6004721” align=“alignleft” width=“380”] Representational image. Reuters[/caption] As this was supplemented with Goods and Services Tax (GST) which sought to integrate the informal economy with the formal structure, the demand for cash was expected to come down. However, tradition has been stronger and has ensured that the demand for currency remains intact. The number of Rs 20 lakh crore may look high, but if one looks at the buildup of cash in circulation over the years, the picture is actually not very shocking. The table below gives the incremental currency in circulation in each of the last five fiscal years with the latest one being for 10 months over March. The table shows that an increase of Rs 2.31 lakh crore, though the highest in this period is not really very odd as it was Rs 2.25 lakh crore in 2015-16, the year prior to demonetisation. The fall in currency in circulation in 2016-17 was made up for in 2017-18 with an increase of almost Rs 5 lakh crore.

Therefore, while the increase this year is not really very out of place it would still call for an explanation given the other data presented by the Reserve Bank of India (RBI) which says that digital transactions have increased in the last few years is evident even today in most transaction-oriented business. The fact that the currency is still held in large quantities is for various reasons. First, households prefer to hold on to cash at home for precautionary motives as it provides convenience and security. The tendency to hold more cash is high in rural areas where digitisation is less pervasive. Second, transactions in the farm sector are still largely cash-based as we have not yet reached a stage where digital transactions take place. While some mandis are linked to the eNAM and similar platforms all transactions which take place outside the mandi are purely cash-based. And given the multiple stages farm products go through before reaching the consumer, there would be increased demand for cash. Third, while the younger generation uses digital modes of transactions there is a large demography which prefers use of cash and hence the demand is always progressively higher with cost of living. Intuitively it can be seen that as inflation increases even by 3-4% per annum, the overall demand for money increases in proportion and hence there will always be higher demand for cash. Fourth, the GST has been a correction in the informal economy. However with the composition rule changing and more companies being out of the net, there is a tendency for cash transactions to increase. While this is a valid argument, the impact should not be overstated as the counterparty would often insist on receipts and hence will force the small and medium enterprise (SME) to get listed. But this can still be argued as being a reason for higher demand for cash as these limits have been liberalised. Fifth, households have also preferred to keep cash in preference for deposits at the margin as interest rates have been low. This has worked at the margin and also witnessed in the lower growth in deposits this year which in turn has put pressure on liquidity as the RBI had to intervene continuously to steady the situation. Sixth, a major factor that will keep demand up would be the elections. This is the time when all parties would be hoarding cash for use during the campaigning as it is the easiest way of spending money without any audit trail. This was observed before some state elections when demand for currency went up. Therefore, one may expect this to continue for the coming months right up to the elections as payments are made either directly to voters or to party workers for various purposes. Seventh, the return of currency for conducting marriages is also evident and has added to overall demand. With the central bank bringing back normalcy in the currency situation, households are returning to the use of cash which still dominates a large part of these expenses. There are, hence, two things about this high level of currency in the system. The first is that it is not really odd in terms of the increase as this has happened in the past too. Demonetisation had withdrawn a large part and the slow infusion was more due to the logistics in supply rather than the ebbing of demand. Second, while digitisation has certainly caught on, it has not been at the expense of currency and the two are moving in parallel. As a corollary it can be said that this trend may continue for some more time before people switch in large groups away from the use of cash. (The writer is Chief Economist, CARE Ratings)

Therefore, while the increase this year is not really very out of place it would still call for an explanation given the other data presented by the Reserve Bank of India (RBI) which says that digital transactions have increased in the last few years is evident even today in most transaction-oriented business. The fact that the currency is still held in large quantities is for various reasons. First, households prefer to hold on to cash at home for precautionary motives as it provides convenience and security. The tendency to hold more cash is high in rural areas where digitisation is less pervasive. Second, transactions in the farm sector are still largely cash-based as we have not yet reached a stage where digital transactions take place. While some mandis are linked to the eNAM and similar platforms all transactions which take place outside the mandi are purely cash-based. And given the multiple stages farm products go through before reaching the consumer, there would be increased demand for cash. Third, while the younger generation uses digital modes of transactions there is a large demography which prefers use of cash and hence the demand is always progressively higher with cost of living. Intuitively it can be seen that as inflation increases even by 3-4% per annum, the overall demand for money increases in proportion and hence there will always be higher demand for cash. Fourth, the GST has been a correction in the informal economy. However with the composition rule changing and more companies being out of the net, there is a tendency for cash transactions to increase. While this is a valid argument, the impact should not be overstated as the counterparty would often insist on receipts and hence will force the small and medium enterprise (SME) to get listed. But this can still be argued as being a reason for higher demand for cash as these limits have been liberalised. Fifth, households have also preferred to keep cash in preference for deposits at the margin as interest rates have been low. This has worked at the margin and also witnessed in the lower growth in deposits this year which in turn has put pressure on liquidity as the RBI had to intervene continuously to steady the situation. Sixth, a major factor that will keep demand up would be the elections. This is the time when all parties would be hoarding cash for use during the campaigning as it is the easiest way of spending money without any audit trail. This was observed before some state elections when demand for currency went up. Therefore, one may expect this to continue for the coming months right up to the elections as payments are made either directly to voters or to party workers for various purposes. Seventh, the return of currency for conducting marriages is also evident and has added to overall demand. With the central bank bringing back normalcy in the currency situation, households are returning to the use of cash which still dominates a large part of these expenses. There are, hence, two things about this high level of currency in the system. The first is that it is not really odd in terms of the increase as this has happened in the past too. Demonetisation had withdrawn a large part and the slow infusion was more due to the logistics in supply rather than the ebbing of demand. Second, while digitisation has certainly caught on, it has not been at the expense of currency and the two are moving in parallel. As a corollary it can be said that this trend may continue for some more time before people switch in large groups away from the use of cash. (The writer is Chief Economist, CARE Ratings)

The number of Rs 20 lakh crore may look high, but if one looks at the buildup of cash in circulation over the years, the picture is actually not very shocking.

Advertisement

End of Article

Written by Madan Sabnavis

Madan Sabnavis is Chief Economist at CARE Ratings. see more

)

)

)

)

)

)

)

)

)