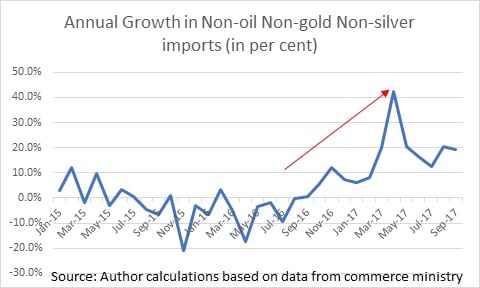

In a few days, the first anniversary of demonetisation will be here. The Narendra Modi government will continue doing what it has done in the last one year — give demonetisation a positive spin. But how can a decision which made 86.4 percent of the currency in circulation useless overnight, in a country where 80-98 percent of the transactions were carried out in cash (depending on which estimate you would like to believe), be a positive one? Let’s take a look at Figure 1. It basically plots the annual growth in non-oil non-gold non-silver imports. Figure 1:  What does Figure 1 tell us? First, it tells us that the annual growth in non-oil non-gold non-silver imports had been rather subdued since January 2015. In fact, it has been in the negative territory several times, especially in a few months before November 2016, when demonetisation was announced. But after November 2016, the growth in non-oil non-gold non-silver imports simply took off and reached a peak of 42.5 percent in April 2017. This basically means that these imports were 42.5 percent higher in April 2017 comparison with April 2016. What does this tell us? It tells us that a significant portion of the consumer demand post demonetisation has been fulfilled through higher imports. So far so good. Demonetisation basically disrupted and destroyed supply chains, both in the formal as well as the informal economy. With supply chains being destroyed, the supply of domestic goods has been replaced by imports and has not been fulfilled through the production of domestic firms. It is worth remembering here that imports are a negative entry into the gross domestic product (GDP) formula. Y = GDP C = Private Consumption Expenditure I = Investment G = Government Expenditure NX = Exports minus imports Hence, if imports grow at a faster pace than exports, they pull down the GDP to that extent. Exports during this year (between April to September) have gone up by around 10.9 percent compared with last year. Imports are up by 22.3 percent. Given this, it is not surprising that the economy has slowed down. The growth for the non-government part of the economy, which forms around 90 percent of the total, was around 4.3 percent during April-June 2017. This was more than 9 percent in early 2016. [caption id=“attachment_4190999” align=“alignleft” width=“380”]  Banned Rs 500 notes. PTI[/caption] Hence, demonetisation has played a huge role in slowing down economic growth. And this is tragic given that one million Indians are entering the workforce every month. In fact, it has also rendered a standard tactic in reviving economic growth, pretty much useless. Allow me to explain. When countries are not doing well on the economic front, the standard prescription offered by economists is for the government to spend more. When the government spends more, the extra spending becomes somebody’s income. When that income is spent, businesses benefit, and the economy revives. The trouble is that in the current situation if such a prescription is applied on India (actually to some extent it already has been), the government spending will eventually create consumer demand, a substantial portion of which will be fulfilled through imports. Imports, as we have already seen, are a negative entry into the GDP formula. Given this, a fiscal expansion instead (the act of government spending more) of creating faster economic growth might just slow it down. The point being that we aren’t done yet with the negative effects of demonetisation. There’s more to come. (Vivek Kaul is the author of India’s Big Government—The Intrusive State and How It is Hurting Us.)

Even an increase is govt spending is unlikely to boost GDP. There seems to be no end in sight yet for the demonetisation-induced pain

Advertisement

End of Article

)