Non-clearance of FDI in multi-brand retail has got its first victim in Pantaloon. News report says that Pantaloon Retail is planning to exit its joint venture with the world’s largest office products company Staples Inc. Cash crunch seems to be the motive behind this sale, which would generate Rs 200 crore for Pantaloon for its 39.5 percent stake.

As per the joint venture, Staples has the first right to buy back Pantaloon’s shares, which it is likely to exercise by June 2012. The JV has recorded sales of Rs 175.17 crore through its 24 stores but has posted a loss of Rs 17.74 crore for year ended June 2011.

Kishore Biyani, CEO of Future Group had earlier said that the company would be exiting such non-core business, including joint ventures. Couple of weeks back the company’s board formed a review committee to consider various options for restructuring and selling in order to reduce debt.

Futures group was betting on investments through FDI route to bail it out of its debt trap. With FDI unlikely to clear soon, the company has now resorted to selling off its non-core business and other joint ventures. Late last year the company unsuccessfully tried to sell Future Capital Holdings and its life insurance business.

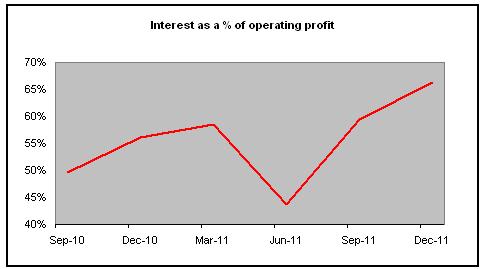

The company is increasingly getting strangulated under its debt burden with interest charges taking away 66 percent of its operating profit in the December quarter as compared to 44 percent in the June quarter 2011. The company as on June 2011 had a debt of Rs 7846.11 crore. High interest outgo resulted in the company barely posting a profit of Rs 4.43 crore for the December 2011 quarter on a sales of Rs 3,174.80 crore.

Impact Shorts

More ShortsPantaloon, due to its cash crunch is not able to grow its topline. Sales has been stagnating at Rs 3,200 crore levels for the last five quarters. However, its profit has been declining on account of higher interest charge though its operating margin has been stable. Cost cutting measures taken by the company like cutting down its staff strength and shutting nine warehouses has helped keep margins intact.

The company is expected to be under further financial stress as it has added 1.5 million square feet of retail space taking its total to 16.3 million square feet. Given the rising interest rate every quarter, the company’s debt position is expected to increase to nearly Rs 9,000 crore.

At such high debt levels, sale of Staples which will add only Rs 200 crore will hardly improve its situation. Rather than using a scalpel, it is high time the management used a sledgehammer if it needs to survive.

)

)

)

)

)

)

)

)

)