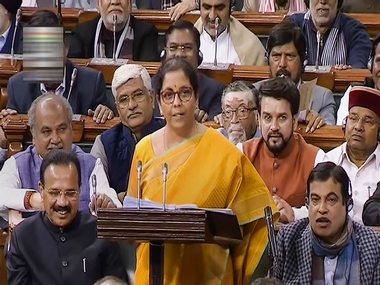

New Delhi: The government on Sunday issued a clarification on the new definition of NRI, stating that “in case of an Indian citizen, who becomes deemed resident of India under this proposed provision (Finance Bill 2020) shall not be taxed in the country unless it is derived from an Indian business or profession.” [caption id=“attachment_7988301” align=“alignleft” width=“380”]  Finance Minister Nirmala Sitharaman presents the Union Budget 2020-21 in the Lok Sabha, in New Delhi. PTI[/caption] The government has also stated that “necessary clarification if required shall be incorporated in the relevant provision of the law.” “The new provision is not intended to include in tax net those Indian citizens who are bonafide workers in other countries,” said the government. The government further said: “In some sections of the media, the new provision is being interpreted to create an impression that those Indians who are bonafide workers in other countries, including in the Middle East, and who are not liable to tax in these countries will be taxed in India on the income that they have earned there. This interpretation is not correct.” The Finance Bill, 2020 has proposed that an Indian citizen shall be deemed to be resident in India if he is not liable to be taxed in any country or jurisdiction. “This is an anti-abuse provision since it is noticed that some Indian citizens shift their stay in low or no tax jurisdiction to avoid payment of tax in India,” the government said. Follow full coverage of Union Budget 2020-21 here

The government on Sunday issued a clarification on the new definition of NRI mentioned in the Budget presented by Nirmala Sitharaman.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)