Mumbai has once again beaten the National Capital Region and Bangalore to emerge as India’s most expensive property market.

In the last two years, the Prime Residential Development Land Index, prepared by real estate consultancy firm Knight Frank, which measures the price of prime residential (apartment or condominium) property, for Mumbai has witnessed an appreciation of 35.2 percent against 24.9 percent for NCR and 26.1 percent for Bangalore due to changes in development norms and increase in prime property prices.

The change in development norms allowed additional compensatory development potential for land in Mumbai. However, a weak economic scenario that impacted office space absorption along with a large quantity of office supply in Mumbai led to a decline in the Prime Office Development Land Index by 13.1% during the past two years. On the other hand, NCR saw a 16.3 percent growth in prime commercial space prices, while Bangalore witnessed a growth of 12.9 percent in the same period.

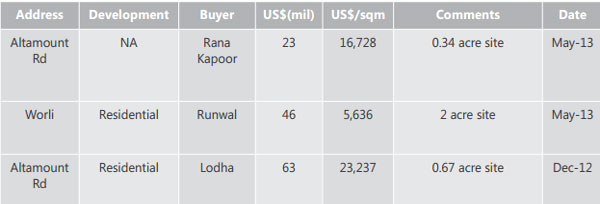

Recent big ticket prime transactions in Mumbai’s residential market

[caption id=“attachment_81117” align=“aligncenter” width=“600”]  Source: Knight Frank[/caption]

“While Mumbai witnessed maximum appreciation in Prime Residential Development Land compared to National Capital Region and Bengaluru, it emerged as the worst performer in the Prime Office Development Land. Low transaction volumes coupled with large quantum of office supply led to this decline, " said Samantak Das, Chief Economist and Director - Research, Knight Frank India.

However, if one just looks at the price trends in the last one year, the index in Mumbaiis up by a marginal 2.8 percent on account of a residential market slump, which stunted price growth, while the Prime Residential Index for NCR showsa 13.8 percent increase year-on-year, mostly on account of high-end apartments in Golf Course Road in Gurgaon that witnessed high appreciation in land values, the Knight Frank report showed.

)

)

)

)

)

)

)

)

)