Ending months of speculation, Infosys yesterday announced appointment of Vishal Sikka, a former SAP executive, as the company’s CEO from 1 August. Investors, and presumably the company’s staff, heaved a sigh of relief as they were expecting the CEO search to continue for some more time, heightening the uncertainty surrounding the company.

However, analysts and company observers are still cautious for various reasons. For one, Sikka comes from a products background, while Infosys is a services company. Given the fact that his experience was with a global major, he will have to adjust to the work culture of an Indian company.

But these issues will subside once he settles down in the business. That is when he will have to take a hard look three of the basic problems that are plaguing the company: attrition, revenue growth and margins.

Attrition: This is the biggest concern that has been bogging down the company. There have been about 12 top level exits and many more middle level exits at the company in the last one year. Brokerages consider reversal of this trend is the most important factor that will improve the profitability. It will also improve the employee morale, as frequent churn unsettles the staff.

A look at the graphic below will help open gauge the gravity of the problem. In 2009-10, the company’s attrition rate was just 13 per cent. Five years later, it stands at 18.7 per cent. Meanwhile, for its peer TCS the rate has remained more or less stable over the same period - 11.8 per cent to 11.3 per cent. It also should be noted that the higher attrition at Infosys during the last financial year was despite the fact that the company hiked employees’ salaries twice.

“We believe unless the company reins in high attrition rate; the recent measures undertaken by the company to improve employees’ productivity would not fructify,” KR Choksey said in a research report after the FY14 earnings release.

Sikka’s appointment is unlikely to set things right. Analysts are, however, predicting more exits.

“While appointment of Dr Vishal is positive in the near term, however he being a external CEO there remains a risk of further senior management exits,” brokerage Kim Eng said in a research report yesterday.

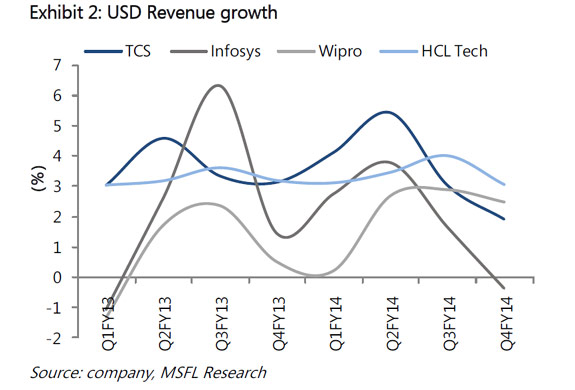

Revenue growth: A sticky area for Infosys. The following graphic shows how the company’s revenue growth has been compared with its peers. In the post results statement, while Infosys was cautious about revenue growth outlook for the next year, TCS looked more confident.

Sikka, for sure, has no magic wand, but he will definitely have to pull up his socks.

Margins: As the graphic below shows, this has been a big worry for the company. According to HDFC Securities, Infosys’ EBITDA margin, a key profitability metrics, stood at 33.7 percent in third quarter of 2012-13, which fell to a low of 26.1 percent in the second quarter of 2013-14, before improving to 28.3 percent in January-March. The moderate improvement has come during the second stint of NR Narayana Murthy.

“However, growth trajectory remained volatile with company slipping behind peers in 4QFY14,” the brokerage has noted. As per the data provided by the brokerage, the company’s EBIT margin has contracted over the last three years from 29 percent to 24.5 percent in FY14.

In its bid to improve the margin, the company is now focussing on application development and maintenance, infrastructure management services (IMS) and pricing.

)