In the Indian car market, small is not beautiful, not any more. In the last few years, car buyers have been supersizing their dreams. Once the favourite of the Indian middle class,small cars, like the entry level Alto, have been trailing their larger cousins.

Now it is the time of entry level sedans.

The rise of the sedan has been a steady one. A research report by Deutsche Bank points out that high fuel prices and inflation have hit demand for entry level cars, which has instead sparked a rise in the number of sedans being sold.

As the graph below shows, the sale of entry level sedans has been on the rise even as other segments declined due to the economic uncertainty in the last two years.

According to Puneet Gupta, associate director (automotive) at IHS, the growth in the sale of sedans has jumped over the last 4 to 5 years with global carmakers jumping into the fray to produce sub-4 metre long cars and the price difference between these models and hatchbacks reducing to as little as Rs 50,000 in some cases.

He pointed to the fact that though prices for hatchbacks and sedans were in the same range, more notional benefit is perceived from the latter type of car by consumers and car companies pushed them aggressively since extended hatchbacks - sedan cars are more profitable.

“For this and the next 1-2 years the sedan sales will continue to grow,” he said.

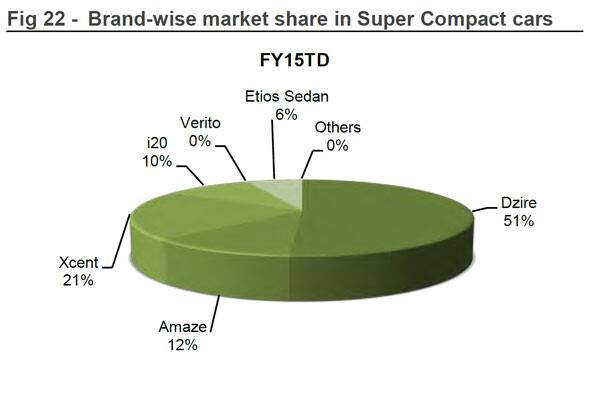

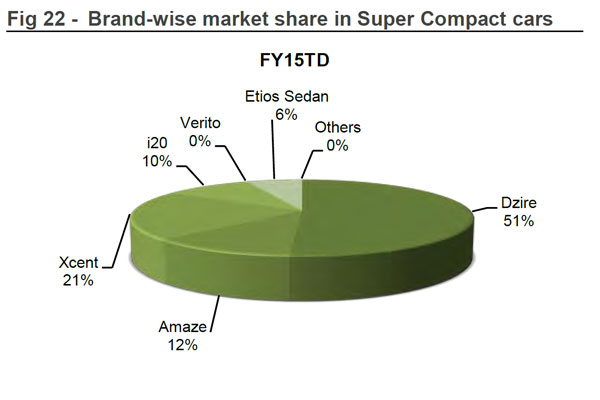

Here’s how the market for small sedans is expected to be divided among the car makers:

[caption id=“attachment_88394” align=“alignnone” width=“600”]

Graph courtesy: Religare[/caption]

Graph courtesy: Religare[/caption]

However, things aren’t foreseen as staying rosy for this type of segment of cars in mid- and long-term and a new segment could grow rapidly over the next five years.

“Over the next four-five years things there would be emergence of compact SUV segment and the percentage share of compact sedan segment will come down. The compact SUV will become more popular and we will see many new launches in compact SUV segment going ahead,” Gupta said.

He pointed to the fact that Mahindra was already working on the S101 compact SUV, and Renault is also working on a similar vehicle. If Maruti and Hyundai also jump into the fray, it would only further boost sales and make prices more competitive.

Here’s how IHS predicts carmakers will produce cars in the coming years:

Gupta cautioned against writing off the compact car just yet. Apart from IHS, even Deutsche Bank expects to see a slowing in sales of sedans, and a pickup of small car sales again:

“Penetration levels of passenger cars in the country are still low and as the economy grows and incomes rise, it will rise as well. There is a very high potential at the entry level,” Gupta said.

Also if diesel prices are deregulated, petrol variants will be favourites, he said. If emission norms are tightened as well, cars could become more expensive which could affect sales. So while the sedan may be putting a smile on the faces of carmakers presently, they will be continuing to bank on the trusted small car to drive sales in the country.

)