With the new BJP government led by Narendra Modi promising speedy reforms to revive the economy, sentiment has definitely improved, especially in the stock markets. The same sentiment is expected in the real estate industry too which has more or less been stagnant for the last two years.Once sentiment in the economy improves, land buying activity is also likely to get a boost which will enable developers to offload assets and improve their balance sheets as well as their cash situation.

“As sentiment improves, so willlikely demand and land purchase activity. This could then make erstwhile deadinvestments of land on books monetizable and translate into an opportunity for abalance sheet fix,” saySaurabh Kumar and Gunjan Prithyani, real estate analysts at JP Morgan in a report dated 19 June 2014.

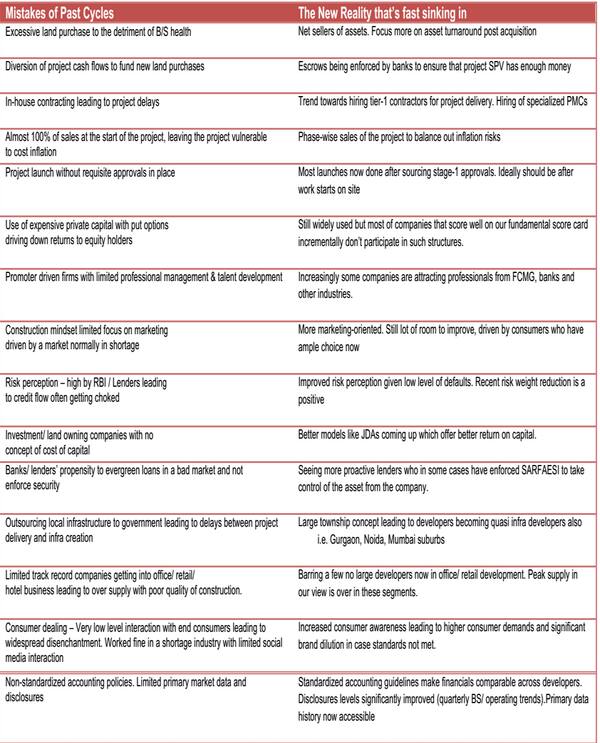

The brokerage also believes that the last three years of slowdown may have actually been a blessing in disguise for the real estate industry. More often than not developersmake the mistake of deploying excessive short-term capital in land, whichdeters on-time project completion and affordable pricing of completed units.

JP Morgan has highlighted some main lessons the industry has learnt from the past

[caption id=“attachment_88952” align=“aligncenter” width=“600”]

Source: JP Morgan[/caption]

Source: JP Morgan[/caption]

Lessons of past also suggest that residential demand is cyclical in nature and when it recovers it comes back with a bang**.**

“In 2009 with only eight months of effective real estate slowdown, pre-sales lock in for most developers went above 2007 highs. A similar case was seen in an oversupplied market like Dubai which once out of a slowdown saw significant increases in transaction volumes.This time, demand especially in cities like Mumbai and Delhi has been pent up for over 3+ years and any recovery will likely be sharp,” the report noted.

)