When it comes to property in Mumbai, it makes more sense for investors to park funds in commercial property rather than residential. This is because the rental yields, the return one makes on the asset without considering the expected capital gain or loss, is very low for residential property. For instance, in Mumbai if you have purchased a house for Rs 1 crore, and your annual rent is about Rs 2,40,000, the rental yield is as low as 2.4 percent.

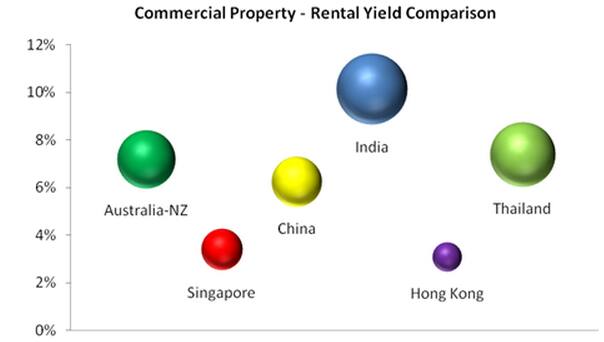

According to real estate consultancy firm Jones Lang LaSalle India, Mumbai and the National Capital Region typically have rental yields lower than 2.5%. However, investing in pre-leased property in the commercial space may be a good option since office or retail assets in metros like Mumbai, NCR, Bangalore and Chennai provide rental yields of 10-12%, which are the highest in the world!

[caption id=“attachment_89992” align=“aligncenter” width=“604”]  Source: JLL[/caption]

Given such high rental yields, investors are now acquiring stakes in partially or fully-leased properties rather than entering at early stage of construction.

“This eliminates the execution risk for investor and provides regular rental income along with possibilities of capital appreciation, and developers enjoy better valuations for their properties,” says Shobhit Agarwal, Managing Director - Capital Markets, JLL India.

Secondly, since the objective is to earn stable rent over a long period of time with the option of exiting the project later, commercial properties score over residential since the lease on them in most cases, an agreement with a corporate, is for a longer tenure of 3 to 9 years while a residential lease arrangement is with an individual and invariably for a shorter term that usually does not exceed 11 months.

)

)

)

)

)

)

)

)

)