Watch out! As we head closer to elections, volatility in the market is set to rise.

As has been the trend over these past few months, Indian equity benchmarks gained further on Wednesday amid choppy trade, with the Nifty hitting another record high on the back of the expiry of March series derivative contracts, while the Sensex advanced 74.78 points to 22,170.

A sustained inflow of foreign funds has clearly influenced trading sentiment.As of 25 March, India led FII (foreign institutional investor) inflows to Asia (excluding China), with $2.89 billion of net purchases by foreign investors.

Since the start of the year, the Nifty has gained 4.53 percent. With foreigners pouring money into Indian assets, the value of the rupee has strengthened, gaining 2.67 percent against the US dollar in the same period, India emerges as one of the best performing equity markets this year.

Here are four reasons why the market could continue moving up:

1. Macro-eco indicators are bottoming out

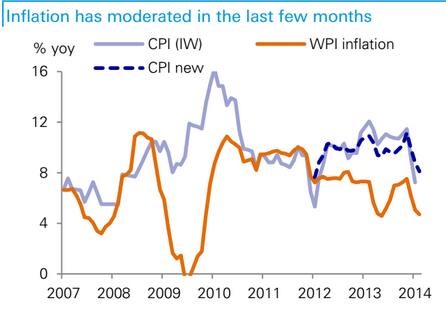

According to brokerage BNP Paribas, the market sentiment is strong and based on the belief that the macro picture is improving - CPI (consumer price index) inflation, after surging to double-digits in late 2013, has been falling steadily ever since.

[caption id=“attachment_80426” align=“aligncenter” width=“446”]  Source: Deutsche Bank[/caption]

CPI inflation eased to 8.1 percent in February from 11.2 percent in November 2013. WPI inflation has also fallen below 5 percent in February, from 7.5% in November 2013.

Deutsche Bank expects further price declines in energy and metal prices, reflecting global developments and the rupee’s recent appreciation.

In addition, GDP growth has stabilised at 4.7 percent in the fourth quarter of 2013 even though it is much lower than the average growth rate of 6.5 percent. The brokerage believes economic growth is bottoming out and there is definitely an upside potential.

[caption id=“attachment_80425” align=“aligncenter” width=“468”]  Source:Deutsche Bank report[/caption]

“High frequency macro indicators such as the manufacturing and services PMI suggest a bottom in activities. Indeed, economic momentum has improved since mid-2013, although the level of activity is clearly well below the comfort level of policy makers and India’s aspirational population,” said Deutsche Bank in a note too.

2. Adecisive new government can help the economy regain growth momentum

The market is expecting Bharatiya Janata Party (BJP) , or a coalition led by the BJP, to win, which should result in a more reform-minded and market-friendly government, says BNP.

[caption id=“attachment_80430” align=“aligncenter” width=“449”]  Source: Deutsche Bank[/caption]

The BJP’s prime ministerial candidate, Narendra Modi, has ‘strong reform’ credentials and has built a reputation as a decisive leader as Chief Minister of Gujarat.The optimism has boosted equity market performance, helped by strong foreign investment inflows since the start of the year.

3. The rupee has strengthened

After sharp volatility around the middle of 2013 due to concerns about India’s high current account deficit (CAD) and weak capital flows, the Indian rupee recovered strongly in September and has remained steady since then, appreciating by 2.55 percent over the last six months.

[caption id=“attachment_80428” align=“aligncenter” width=“423”]  Source: Deutsche Bank[/caption]

This improvement was helped by decisive action from the government and the Reserve Bank of India, including restrictions on gold imports and retail fuel price reforms to lower oil imports, said BNP Paribas.

It estimates that these measures helped to reduce the CAD from over 6 percent of GDP to less than 1percent in Q4 2013. Expectations of economic recovery and a positive election outcome have significantly improved capital inflows into both equities and bonds, further supporting the rupee.

So basically India today is in a much better position than it was six months ago.

Policy actions have reduced the economy’s external account deficit and reliance on short-term external flows, fiscal consolidation has continued and respite from inflation seems likely going ahead. The markets have rallied considerably in anticipation of an economic reforms-friendly election outcome. As a result, foreign investor interest has surged, the rupee has been remarkably strong, and latest data suggest an economic recovery is in the making.

)

)

)

)

)

)

)

)

)