The results of the elections in the world’s biggest democracy has finally been announced.

A landslide election victory for Narendra Modi’s Bharatiya Janata Party (BJP) has created euphoria in India’s financial markets, driving shares to life-time highs and the rupee to its strongest level against the dollar in 11 months.

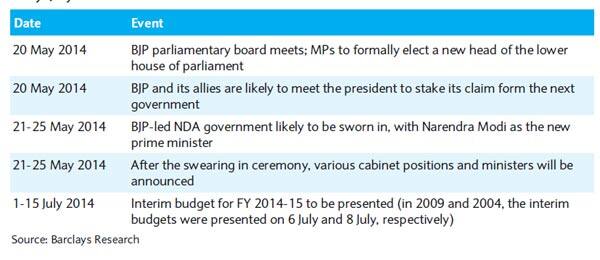

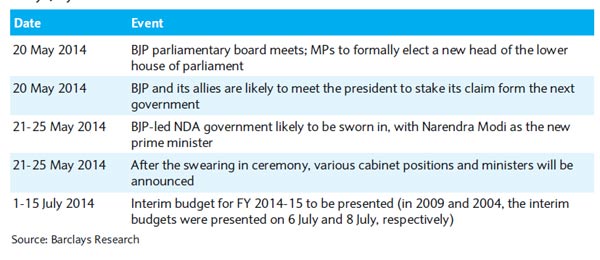

So, now that elections are out of the way, what’s the next trigger for stock investors? Well, there are a couple of key dates/events to watch out for.

A Barclays India report dated 20 May notes that the bigger events in terms of policy announcements will be keenly watched once the new government is formed.

A fundamentalturnaround in the investment cycle is several years away,but near-term volatility is likely to surround some key events.Here are some of the days that investors should mark on their calendars:

Cabinet formation: In the immediate future, the focus shifts to the swearing in ceremony of the new government, and the formation of the cabinet.

While the new government under Narendra Modi is likely to be sworn in some time later this week, the dates are not yet final.

According to the president of the BJP, the parliamentary members of the BJP and its NDA allies will meet on 20 May (today), reports say they will visit the president to stake a claim to form the next government. As experts note, reform prospects in the 12-15 economically important ministries will depend on the minister/political party that gets them.

The cabinet formation, therefore, will drive perception of reform potential in these economically relevant ministries.

Another key trigger for the markets will be the onset of the monsoon. By mid-June, the monsoon progress will become increasingly visible, a Credit Suisse report notes.

With reservoir levels higher than normal, a 15 percent belowaverage monsoon may not hurt much, but a miss of more than 20 percent could upset investors. In other words, the onset of monsoon is almost certainly to affect market sentiment.

According to the India Meteorological Department,monsoon rains have reached the Andaman Sea and parts of the Bay of Bengal. The monsoon is likely to reach the mainland through Kerala about four days later than the normal date of June 1.

Finally, another key trigger will be the Budget. This will be the first major policy document from thenew government, so it will be all-important.

More than the annual revenues and expenses,the document should spell out some important policy decisions, inparticular, the recapitalisation of PSU banks; the government’s approachto keeping the fiscal deficit low; a roadmap for important issues like DTC, GST; as well as the government’spriorities (defence, rural development, taxation, subsidies, etc.).

While there is no confirmation as yet, the expectation is that the budget will be presented in the first half of July.

[caption id=“attachment_85213” align=“aligncenter” width=“600”]  Source: Barclays report[/caption]

)

)

)

)

)

)

)

)

)