India’s internet market is about five years behind China in areas such as consumer adoption and usage patterns, investment in high-speed telecom infrastructure and value proposition and consumer experiences offered by online companies.

That’s according to a report by Goldman Sachs on India’s internet industry.

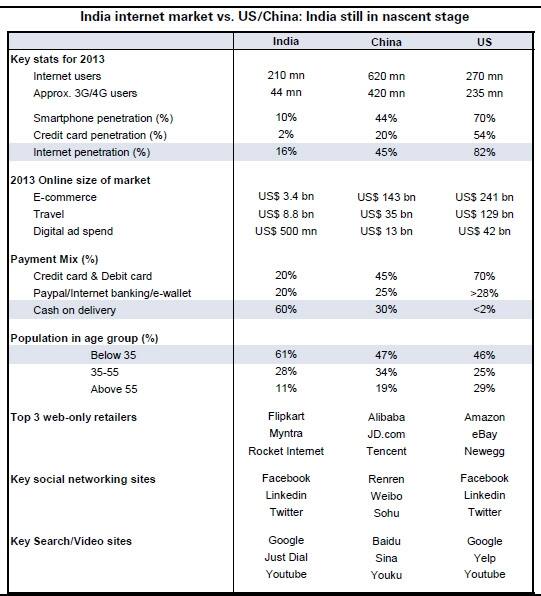

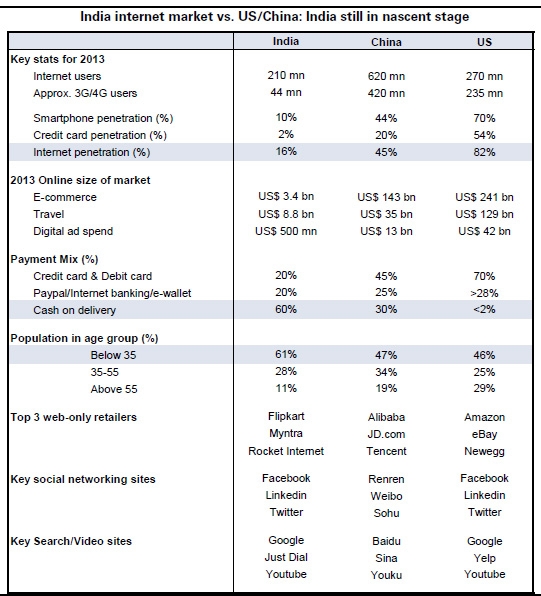

The report pegs India’s e-commerce industry value at $3.4 billion for 2013. But with a nationwide internet penetration rate of only 16 percent, single-figure credit card penetration (2 percent) and a heavy bias for cash-on-delivery transactions (60 percent), India’s stats pale in comparison to more mature markets like the US and China_(See table below)._

One of the key reasons why the Indian internet market lags the US and China is that the “trust factor” is low among Indian users, notes the report.

Take a look at the chart below.

[caption id=“attachment_83017” align=“aligncenter” width=“541”]  Chart from the Goldman report.[/caption]

“We estimate that approximately 60 percent of Indians prefer “payment on delivery” rather than pay using credit/debit card”, it says. However, given that India’s population mix is younger compared with the US and China, and that younger people embrace technology much more warmly, the growth of e-commerce should pick up over the next few years, adds the report.

For now, the cash-on-delivery payment system is a god-send for the Indian customer, who is wary of online frauds and prefers to see, in person, what he or she is paying for. It also works because, as can be seen in the table, credit cards as a payment mode have not gained much popularity in India.

Not surprisingly, that highly anticipatedexplosion in e-commerce has not happened so far. As Goldman Sachs’ report notes, “We are yet to see a hyper-growth revenue phase in India similar to that in US or China as we believe that the key ecosystem enablers are not yet in place in India."

While the “cash on delivery” format does not seem to have posed a problem for large players, such as Flipkart and Snapdeal, smaller e-commerce platforms could find it difficult to stay profitable under this model.

What will it take to make Indian shoppers more comfortable about purchasing online?

Three things need to happen, according to the report:

1) Improvements in the “payments ecosystem”, or the infrastructure network for making online payments will be very important going ahead.

- The evolving business models of internet companies will also affect the profitability of traditional or offline rivals, and force bricks and mortar firms to merge/acquire or enter the online arena directly. That will increase the number of companies offering goods and services online, which, in turn, will encourage shoppers to try online offerings.

3) Internet companies need to focus on easy to use applications and “mobile first” strategies to enhance customer experience.

Solutions are coming up gradually. An Infosys blog postmentions capitalising on the widespread use of mobile phones in the country – encouraging transactions via mobile payment services and apps and portable credit/debit card readers, which allow cards to be swiped on mobile phones once the customer is satisfied with the product.

Even the country’s central bank, the Reserve Bank of India, is hoping that will be the case, as it has advocated for two-stage verifications for online transactions to encourage and protect such transactions.

Still, it will take some time before India’s e-commerce industry leapfrogs those of the US and China. The potential is certainly there. Until the payments ecosystem improves comprehensively, India’s e-commerce industry will be destined to remain a relative under-performer.

)

)

)

)

)

)

)

)

)