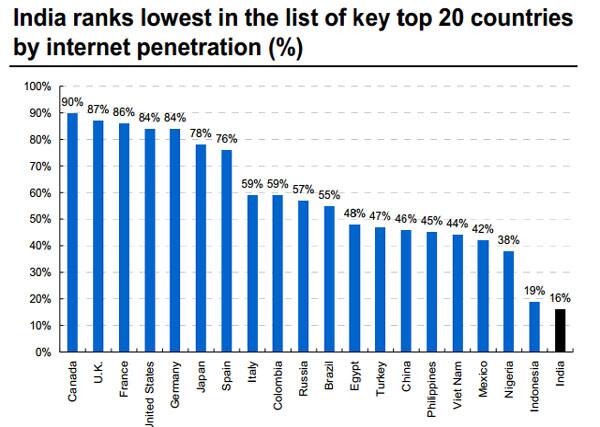

Internet penetration. That’s where India is beating China, hands down. Even though the total number of internet users in India is estimated at around 200 million, it is still amongst one of the lowest in the top 20 countries. While Google’s Eric Schmidt believes the India market now is similar tothe US internet market in the mid-90s, a Morgan Stanley report says India’s internet penetration now is where China was in 2006-2007.

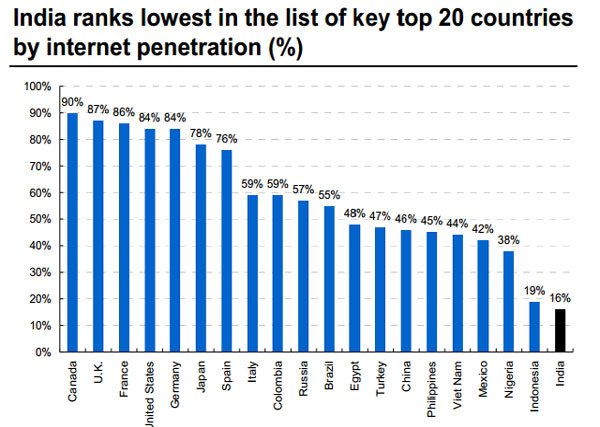

“Indian internet penetration at the end of 2013 was whereChina was in 2007. The gap in overall penetration betweenthe two has increased over the past few years. We believeChina internet usage benefitted from sustained, large-scalegovernment investment that so far has not occurred in India,” said Morgan Stanley.

Sample this:The US had 25 million internet users in 1995 (9%penetration) - the same number of users as India in 2004 andChina in 2000. In 2013, India had213 million internet users, thesame as China in 2007.

[caption id=“attachment_79635” align=“aligncenter” width=“600”]  Source:Morgan Stanley[/caption]

Also,China took 6-7 years to reach 10% internet penetration in 2006, after which its penetration rate trebled, to over 34% in 2010. India’s penetration rate was 10% in 2011, and Morgan Stanleyestimates it rose to 17% in 2013 and could reach 25% by 2016.

[caption id=“attachment_79636” align=“aligncenter” width=“600”]  Source:Morgan Stanley[/caption]

If one compares the amount spend on online advertising,US spends a whopping 1.6 percent of GDP whereasChina and India spend only around 0.4 percent and 0.3 percent.

Morgan Stanley believes India is at least five years away from the cusp ofsuch a dramatic rise in online advertising spending but expectsthe e-commerce segment to be the fastest-growingsegment over the next three years.

Secondly, unlike China, India is not a regulated market and the market opportunities are large for both local and MNC players.

“We expect largecompanies to continue investing in growing the online marketover the next 2-3 years. Consequently, we think the smalleronline companies in each segment are likely to opt forconsolidation over the next few years,” said Morgan Stanley.

Thirdly,Mobile ad revenues forms 11% of total online ad spend inIndia, which is similar to that in the US.

Clearly mobile internet is driving the significant increase inincremental users in India, but usage in terms of frequencyand time spent still lags that in developed countries such asthe US. The number of internet users in India is growingrapidly and catching up fast with the US, and the number ofmobile subscribers in India exceeded those in the US in2006-07.

Fourth, Morgan Stanley is betting big on e-commerce and expects the market togrow 50 percent year-on-year to$16.5 billion in the next three years. Comscore also estimates the internet in India has a 60 percent retail category penetration, compared with a global average of74 percent andmobile accounts for over 20-30 percent of total transactions.

As much as 80 percent of e-commerce in India relates toconsumer electronics or apparel, and consumer electronicssearches are at least 3 times that of apparel. What is even moreinteresting is that more than 50 percent of e-commerce transactionsare from non-metros.

Yet, the industry faces several challenges such as slow monetization, high traffic acquisition costs because of low usage, access tolocal language content andrising industry competitionfrom global majorssuch as Amazon India, Linkedin, Facebook, Expediaand Google for traffic and market share.

)

)

)

)

)

)

)

)

)