The answer might surprise you: It’s Britain’s Marks and Spencers.

In the last five years,India’s retail market has seen a significant shift in retailer attention, with select luxury brands likeMango, LV, Herms,Forever 21 and Gucci increasing their presence in the Indian market.

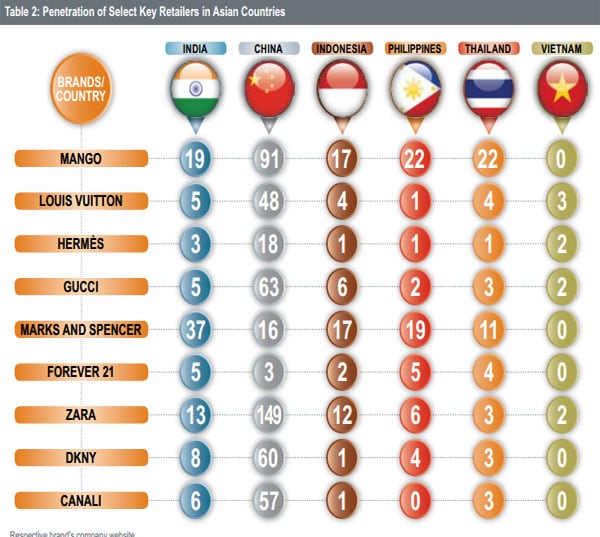

According to a report by real estate consultancy firm Jones Lang LaSalle, UK’s Marks and Spencer has 37 stores in India, followed by clothing brand Mango, with 19 stores, and Zara, with 13 stores.

[caption id=“attachment_79748” align=“aligncenter” width=“600”]  Source:JLL[/caption]

Ironically, Marks and Spencer has a much larger presence in India than in China. The British retailer has only 16 stores in China, while it has more than twice that in India.

Even relatively lower-priced fashion retailer Forever 21 has more stores in India than in China. In fact, when considering China, Vietnam, Thailand, Philippines and Indonesia, only India and Philippines can boast having five stores each, while Vietnam has none. China has only three Forever 21 stores.

However, Spanish brand Zara has a clear preference for China with 149 stores against just 13 in India.

There does seem to be a correlation between income growth and higher per capita retail space (more income leads to more spending, which encourages more retail outlets). For instance, China has the highest level of income growth as well a higher per capita retail space when compared to India. Also in India, theretail space is low mainly because the retail industry is still in its nascent stage.

India and Vietnam clearly lag the rest of their Asian neighbours when it comes to retail industry development.

Here’s a chart from the shows the per capita income and per capita retail space in China, Vietnam, Indonesia, India, Thailand and Philippines

[caption id=“attachment_79750” align=“aligncenter” width=“600”]  Source:: Global Insight, Real Estate Intelligence Service 4Q13 (Jones Lang LaSalle)[/caption]

The above table shows India has witnessed an annual income growth of about 10.0 percent, while China has seen a 16 percent growth in income. But when it comes to retail penetration, India is still at an embryonic stage.

“The wide gap in penetration of thesebrands between India and China suggests that Indiais only emerging in these categories. The potential forfurther penetration of these brands is high given thatsupply of right quality of mall increases,” said JLL in a report.

)

)

)

)

)

)

)

)

)