Amid hopes of a stable and reform- oriented government after the general elections, foreign investors pumped in a buoyant Rs 9,600 crore in Indian equities in April, the eighth consecutive month of inflows.

Foreign Institutional Investors (FII)bought shares worth Rs 74,985 crore and sold stocks to the tune of Rs 65,383 crore, resulting in a net inflow of Rs 9,602 crore ($1.6 billion), according to data from the Securities and Exchange Board of India.

This was the eighth consecutive month of net inflows by foreign investors, and marks a significant turnaround in sentiment after they pulled out Rs 5,923 crore from the stock market in August last year, on worries over the US Federal Reserve’s plan to taper its massive asset-purchase programme.

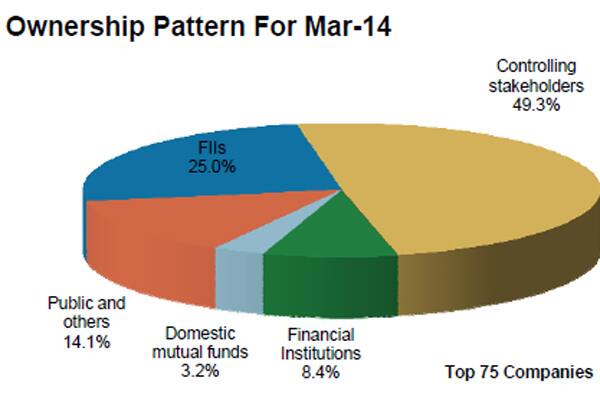

Since the start of the year, money has poured into the Indian stock markets; in fact,FIIs now own a quarter of the top 75 companies, according to a Morgan Stanley report. The report notes that in the first quarter of FY2014, foreign investors were buyers of Indian equities, with their stakes rising to 25 percent. The trend in the broader market was similar, with FII ownership rising to 22.3 percent.

[caption id=“attachment_84064” align=“aligncenter” width=“600”]  Chart from Morgan Stanley report.[/caption]

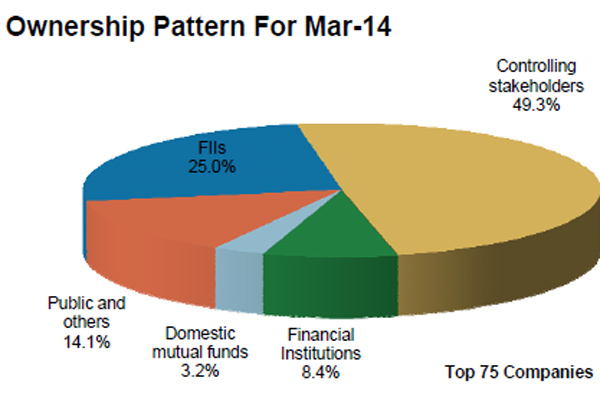

During the first quarter of FY'14, FIIs bought in two out of 10 sectors, with Financials seeing the most buying and Staples the most selling. As of the end of Mar-14, FIIs appear to be most overweight in Financials, followed by Consumer Discretionary (consumer durables).

[caption id=“attachment_84066” align=“aligncenter” width=“600”]  Chart from the Morgan Stanley report[/caption]

Morgan Stanley estimates total value of FII holdings in India at $279 billion. In 2014 alone, foreigners have poured in around $5 billion in Indian stock markets.

But experts say this is just the beginning. Foreigners may invest more in Indian stocks after the Lok Sabha polls end and there’s a new, stable government in place.

Fingers crossed.

)

)

)

)

)

)

)

)

)