There are many reasons why investors are keen to claim a piece of the booming Indian e-commerce sector - from a burgeoning young, internet-savvy population to a rising middle class with disposable incomes to increasing mobile penetration that is opening up the country’s untapped rural market to online vendors.

With news breaking nearly every week of a new e-commerce site scoring investor funds,_Firstbiz_decided to consolidate the information floating around from the last few years to give you a clear idea of how the Indian e-commerce sector is placed.

There’s no doubt big players like Flipkart and Snapdeal are the investor darlings, with the former attracting over $360 million in just 2013 alone. TechCrunch reports that since 2007, Flipkart has raised over $540 million from the likes ofBelgium-based Sofina, US-based Morgan Stanley Investment Management, Vulcan Capital (founded by Microsoft co-founder Paul Allen), Tiger Global, Naspers and Accel Partners.

Rival website Snapdeal hasn’t done too badly either: it raised $50 million in April 2013 and, more recently (February 2014), $133 million from an eBay-led investor consortium.

Other websites are also popping up on investors’ radars. Early this year, fashion portal Myntrareceived funding worth $50 million (about Rs 30 crore) from a group of investors led by Premji Invest, the family investment arm of Wipro Chairman Azim Premji.

Much smaller players have also been catching the eye of investors: media outlets have reported that online jewellery sellerCaratlaneraised $15 million in May 2013;CarDekho,dedicated to India’s petrol heads, secured $15 million from Sequoia Capital in November 2013; while e-commerce sites HealthKart ($14 million)andBabyOye ($12 million) raised funds in the first half of 2013.

One interesting fact is that certain investors, such as Sequoia, Accel, Tiger Global, Intel Capital and Nexus Ventures, are betting big on the Indian e-commerce boom, with multiple investments in one or more websites.

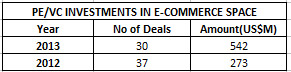

Here’s a breakdown of the investments, courtesyVentureIntelligence, a research organisation focusedon private equity, venture capital and M&AinIndia.

In terms of where the money is going,an Internet and Mobile Association of India (IAMAI) report titled’e-Commerce Rhetoric, Reality andOpportunity’,sites that offer a variety of products from multiple brands (called horizontal sites in techspeak) like Flipkart and Snapdeal appear substantially more attractive to investors as opposed to niche sites that focus on single category products.

The chart below shows that, in 2012, horizontal websites saw 16 infusions worth about $350 million, with the average investment value coming in between $200-$250 million. The next big category was apparel, which got only half the number of investments (eight) but scored on another front - the average investment value in this category was almost $100 million more than those in horizontal sites, at approximately $375 million.

[caption id=“attachment_81295” align=“alignnone” width=“600”]

[/caption]

[/caption]

And from the steady flow of news about investments since the start of this year, 2014 looks like it will be a very positive year for e-comm websites.

)