India has witnessed some major turbulence on the economic front in the past one year.

Not surprisingly, it has suffered over the past one year in terms of foreign investment. Foreign direct investment (FDI) slipped to US$20,766 million ($20.7 billion) between April 2013 and February 2014 compared with Rs 20,899 million a year ago.

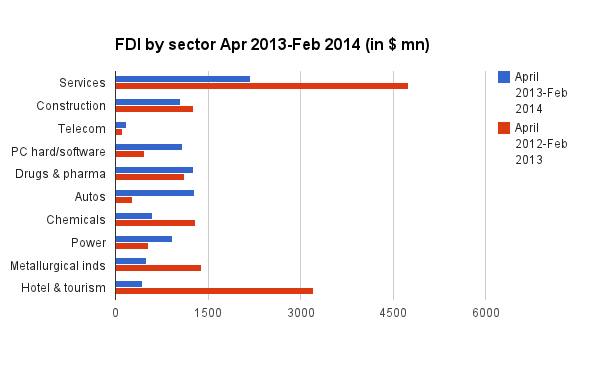

However, inflows into some sectors were affected more than most.According to a PTI report, FDI into the services sector suffered one of the biggest hits: inflows declined 54 per cent to $2.18 billion during April-February of 2013-14 from a year earlier (see chart below).Services, including banking, insurance, outsourcing, R&D, courier and technology testing, received $4.74 billion of FDI during the same period in the year before, according to data from the Department of Industrial Policy and Promotion (DIPP).

The services sector contributes over 60 per cent to India’s gross domestic product. In 2012-13, foreign investment in services fell to $4.83 billion from $5.21 billion in 2011-12.

Apart from the services sector, inflows also declined in the construction, metallurgical industries and hotel and tourism sectors. In fact, the hotel and tourism sector also suffered a steep 86 percent drop in FDI during April-February 2014.

[caption id=“attachment_83969” align=“aligncenter” width=“600”]  Data from DIPP[/caption]

The good news is that there are indications that foreign inflows will increase after the new government is formed.According to experts, foreign investors will move ahead with their decisions once a new government takes over after the ongoing Lok Sabha elections.

A recent Care Ratings report noted that thegeneral expectation is that the economy will improve in FY15, albeit gradually on the premise that a strong government will be in place after the elections, which will reduce uncertainty in the business environment and focus on reviving growth.

“Although the present government has taken steps to attract investments, more needs to be done by the new government,” Krishnan Malhotra, an expert on FDI with corporate law firm Amarchand & Mangaldas told PTI.

Overall, as noted earlier, foreign direct inflows into the country declined to $20.76 billion during the first 11 months of FY14 from $20.89 billion during April-February 2013.

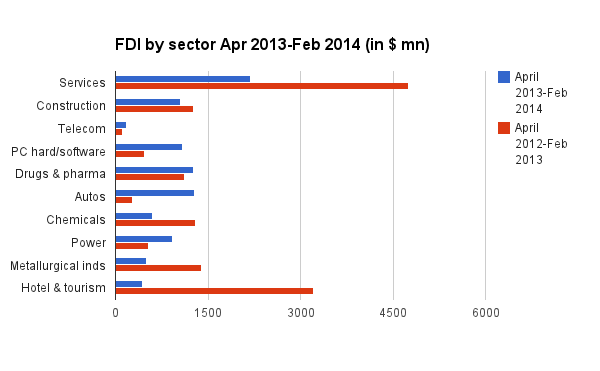

DIPP data also showed Mauritius remains the largest foreign investor so far, based on cumulative inflows between 2000 and 2014, followed by Singapore and UK. That means the top two largest foreign investors in India are tax-haven nations. The US was the fifth largest investor in India.

[caption id=“attachment_83968” align=“aligncenter” width=“600”]  Data from DIPP[/caption]

Foreign investments are considered crucial for India, which needs a massive $1 trillion in the five years to 2017 to overhaul infrastructure such as ports, airports and highways to boost growth.

In addition, a drop in foreign investment could affect the country’s balance of payments situation and the rupee exchange value against major currencies.

Note: FDI for all countries includes inflows under NRI Schemes of RBI.

With inputs from PTI

)

)

)

)

)

)

)

)

)