The dynamics of manufacturing are changing rapidly around the world.Countries that used to be considered low-cost manufacturing destinations are fast losing their advantages, even as new manufacturing centres emerge.

Mexico, for instance, has lower manufacturing costs than China, once among the lowest-cost manufacturers in the world, according to recent research by the Boston Consulting Group.In western Europe, the UK has become the cheapest location, BCG research notes.

According to BCG’s global manufacturing cost competitiveness index, which tracks production cost changes over the past decade in the world 25 largest goods-exporting nations, showed that the six out of the top 10 countries with the lowest manufacturing costs are in Asia, while the rest come from North America and Eastern Europe.

The 25 countries account for nearly 90 percent of global exports of manufactured goods, BCG said.

Some other key highlights of the report:

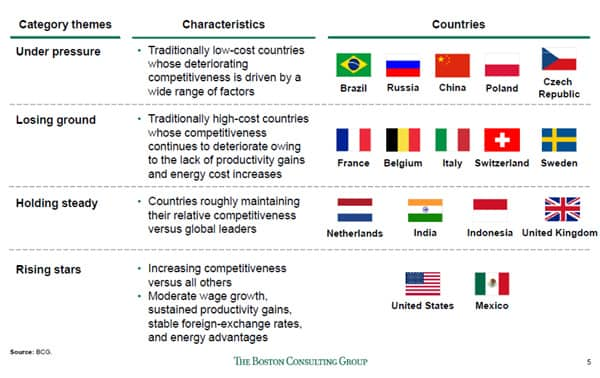

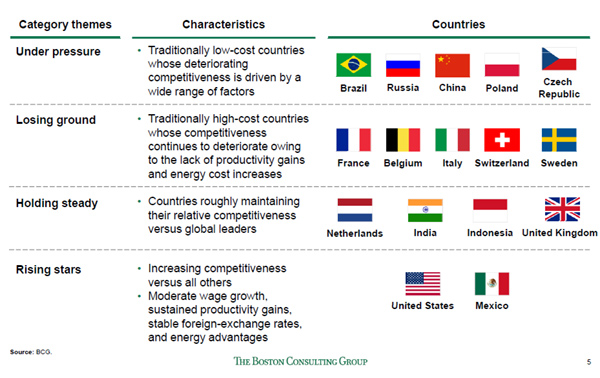

Five economies traditionally regarded as low-cost manufacturing - China, Brazil, the Czech Republic, Poland and Russia - are facing a decline in their cost competitiveness since 2004 due to rising wages and energy costs, lagging productivity growth and unfavourable currency swings. BCG notes that China’s manufacturing cost advantage over the US has shrunk to less than 5 percent. These countries are classified as ‘under pressure’.

Some countries in Western Europe, such as Switzerland and Italy, that used to be expensive manufacturers, have become even more higher cost. These countries are classified as ‘losing ground’.

Some countries managed to keep their manufacturing costs steady, due to a variable mix of declining currencies, and rising productivity growth, which managed to offset any wage hikes and kept overall costs in check. A good example of this group of countries, classified as ‘holding steady’, is India.

In some countries, such as Mexico and the US, overall manufacturing cost structures have improved significantly due to stable wage growth. The gains are mainly due to steady exchange rates and wage growth, sustained productivity gains, and strong energy advantages. These countries are classified as ‘rising stars’.

In fact, overall costs in the US are 10-25 percent lower than those of the world’s ten leading goods-exporting nations other than China. Meanwhile, in some nations with low direct-manufacturing costs, BCG found that competitiveness could be undermined by other factors, such as a difficult business environment or poor logistical infrastructure.

Here’s a chart that shows how different countries have fared between 2000 and 2014.

[caption id=“attachment_84029” align=“aligncenter” width=“600”]  Table from BCG report[/caption]

The findings, BCG notes, have implications for both companies and governments as they consider their manufacturing options.

While China has been losing its cost competitiveness, India has maintained it in the manufacturing arena. Now, it needs to do is build on that stable advantage. That will require focused policies to boost the manufacturing sector and create jobs.

)

)

)

)

)

)

)

)

)