With the BJP trouncing the Congress to get a thumping majority in the 2014 Lok Sabha polls, the benchmark Sensex hit a record high of 25,000 in intra-day trading on vote counting day before slipping back to 24,000 levels.

Modi got the high five from the country’s premier capital market in the hope that he would be able to infuse the country’s sagging economy with a much-needed change in the investment climate and generate jobs.

On Friday, as the election results were being announced, the Sensex shot to an all-time record high of 25,375,63, going up almost 6.1 percent before ending the session up 0.9 percent. This percentage rise made it Asia’s third-best performer in dollar terms so far this year, after Indonesia and Pakistan.

The 30-share index soared by a robust 1,128 points - its best weekly gains in nearly two-and-a-half years - on strong buying momentum on 16 May.

The astronomical ascent has been driven primarily by foreign investors, who have poured more than Rs 1 lakh crore into equities since Narendra Modi was announced as the BJP’s prime ministerial candidate in September 2013.

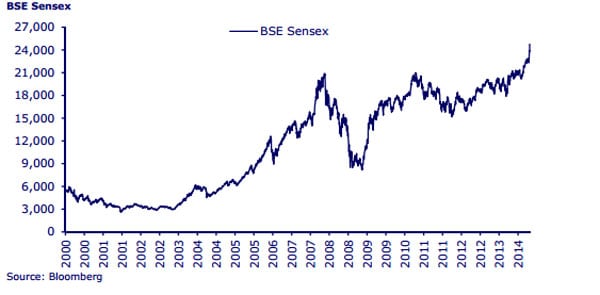

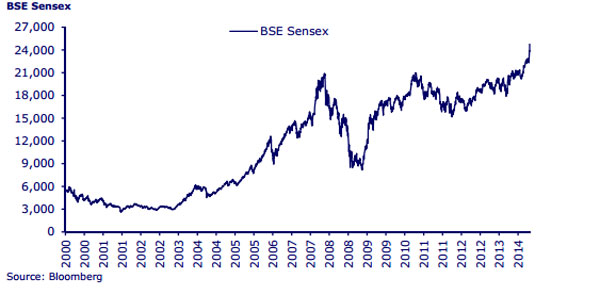

The chart below shows the Sensex’ movement since 2000. The index is now a little over four times what it was back then. If you consider the period between 2001 and 2014, the Sensex dipped even lower to 3,000 before rising again. In other words, between 2001 and 2014, the Sensex increased eight times.

Yes, the Sensex has come a long way.

Chart source: CLSA Greed and Fear report (May)

)