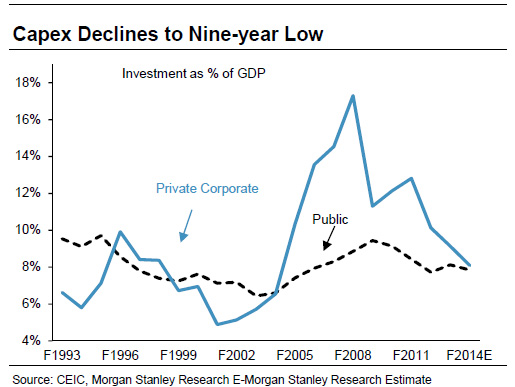

Under the UPA-led government, capital expenditure has fallen to a nine-year low, according to a recent Morgan Stanley report (see__chart below).

It’s no secret that investment - public and private – has remained tepid since the 2008 global credit crisis.Public and private investment fell from the peak of 26.2 percent of GDP in financial year 2007-2008 to 17.3 percent in financial year 2012-2013, according to the report titled"India Economics: Five Key Reforms to Fix India’s Growth Problem".

The compounded annual growth rate of private investment slumped to 1.4 percent between financial year 2007-2008 and financial year 2012-2013, from 43 percent in the previous five years, the report said.

While the global credit crisis and the subsequent sovereign debt crisis in Europe can take some of the blame, “the subsequent continued deterioration in the domestic environment is the main cause for the prolonged weak investment trend,” noted the report.

Regulatory issues, corruption-related investigations, inflationary pressures and the rising cost of capital have leashed the investment cycle.A poor business environment has also lowered expectations of the return on new investment.Indeed, regressive steps, such as retrospective changes to tax laws, have further muddied the investment climate.

The current government has taken some baby steps towards correcting these problems, but they are too little, too late.Reviving investments will be a top priority for the next government, irrespective of who wins elections.

On Monday, Piyush Goyal of the Bharatiya Janata Party noted that the investment cycle needed a ‘credibility quotient’ to get it going again . The party’s prime ministerial candidate, Narendra Modi, he said, “could provide stable leadership” that would not waver. In other words, Modi could up the “credibility quotient”.

Be that as it may, the issues plaguing the investment cycle are not just about a lack of decision-making at the centre.

The report highlights delays in getting approvals and dealing with multiple agencies at the central and state level - which often give conflicting decisions - as the main reason for projects stalling/getting delayed (see chart below).

In general, industrial/manufacturing companies are also currently burdened by high levels of debt (see chart below).That reduces the ability of companies to make new investments. Fixing the balance sheets of companies is, therefore, a pre-requisite for any new capex expansion, notes the report.

However, improvement in corporate balance sheets alone is not enough. The banking sector should also beable to provide the requisite funds. However, banks are currently saddled with impaired loans. A recapitalisation of the banking system and a clean-up of the public sector banks’ balance sheets will be required to improve credit growth, noted Morgan Stanley (see chart below).

Note: GNPL refers to gross non performing loans.

Fixing all of this will be quite the task for the next government. Good luck to whoever’s doing that.

)