Economists, investors and everyone in between have been rejoicing over India’s narrowing current account deficit (CAD).

In the October-December quarter, the previously ballooning CAD shrunk to a four-year-low of $4.2 billion. How was that achieved?Answer: Mainly due to falling gold and capital good imports and an appreciating rupee.

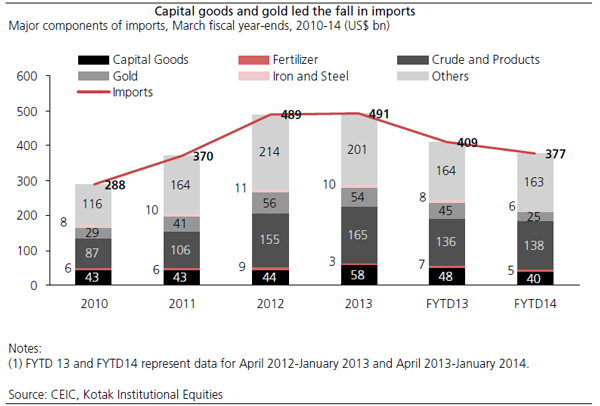

A Kotak Institutional Equities Strategy report notes that in April 2013-January 2014, imports fell by $32 billion (compared with the same period a year ago), out of which gold accounted for roughly $20 billion, while capital goods accounted for $8 billion. The rest of the decline could be notched up to declines in fertiliser, iron and steel, crude and other product imports.

Thanks to strict curbs imposed on gold imports by the government and the monetary authorities from the middle of last year, the value of gold imports from April 2013 -January 2014 plunged nearly $40 billion from the same period a year earlier. Capital goods experienced a similar drop – of just under $30 billion – for the same period.

Looking at gold specifically, the import value of the precious metal has plummeted since June 2013, when the RBI’s import restrictions came into effect. In June alone, gold imports dropped $5.8 billion from May. The low imports continued in August and September, with imports coming in at a low of $700 million. But you have to keep in mind that these numbers exclude smuggled gold estimates.

While gold imports have dropped because of the tighter curbs imposed by the regulatory authorities, the overall decline in imports also suggest weak manufacturing and consumption activity. Therefore, while imports have fallen drastically, improving the country’s CAD, the drop in imports – and exports – indicate sluggish economic economic activity.

The CAD has shrunk, but so has economic growth.

)

)

)

)

)

)

)

)

)