Even as the media and economists are speculating over the likely relationship a BJP government - if it manages to gather enough favourable allies and gets comfortable majority - would have with the Reserve Bank of India (RBI), here is a bit of bad news for the party’s prime ministerial candidate.

Given the troubles in the economy, the central bank may actually have to increase rates, forget about cutting them in the near future.

The key issue in the economy is inflation. According to a Reuters poll of 20 economists, Inflation probably remained stubbornly high in April, despite the RBI having increased interest rates three times since September.

Economists in the poll expect April retail inflation to edge higher to 8.48 percent from a year earlier, and wholesale to 5.73 percent, the report said. This is particularly bad as in March, retail and wholesale inflation had risen to 8.31 percent and 5.70 percent, respectively.

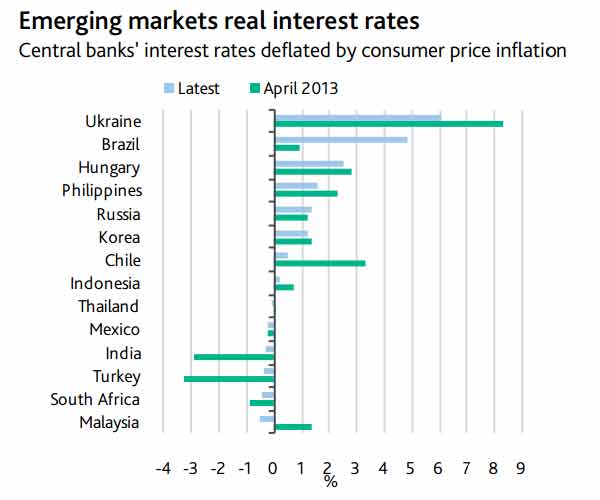

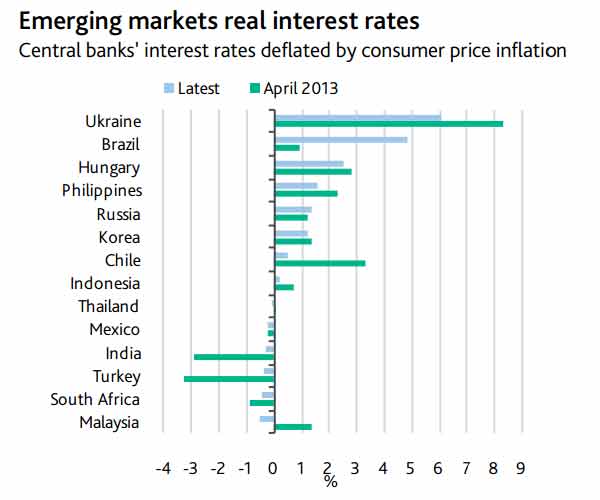

The high inflation has been eating into investors’ savings for a while now. According to the Global Macro Outlook 2014-15 by Moody’s, India is one of the five emerging market economies where real interest rates continue to be in the negative. The situation has witnessed major improvement compared with a year ago period, when the real rate was near a negative 3 percent. The real interest rates continuing in the negative zone is a big disincentive for savers. For the rate turn positive, the central bank will have to raise interest rates further.

[caption id=“attachment_84343” align=“alignnone” width=“600”]

Source: Moody’s[/caption]

Source: Moody’s[/caption]

And Moody’s doesn’t rule out such a possibility.

Growth prospects for India are similarly hampered by a lack of reforms in recent years, which is a strong criticism of the shoddy governance of the United Progressive Alliance government.

It has also warned that the current account deficit, which current finance minister P Chidambaram famously claims to have brought under control, could return to haunt the country once the restrictions on gold imports are lifted.

“Moreover, high inflation, at more than 8% in March 2014 , implies that the central bank has no room to ease monetary policy in the short term and may even need to tighten further,” it said.

Further the increase in capital flows witnessed over the last two to three months is because of hopes that the new government will continue Chidambaram’s reform processes. But even if the new government pushes for strong reforms, a pick-up in revival is unlikely to happen any faster.

“Even if the new government pursues a strong reform agenda, the depth of the issues to be addressed means that India’s economy is unlikely to return to previous growth rates of around 7%-8% in the near future,” it has said.

But the question now is, has Modi got any strong reform agenda at all? From whatever he said in an interview to Times Now yesterday, he doesn’t seem to have any.

For instance, to a specific question on subsidy, which has been a contentious issue for economists and rating agencies alike, the answer he gave was far from satisfactory.

“Firstly, even in Gujarat, the central government has reduced our quota. I am fending for 11 lakh families from the state government’s budget. Can I let the poor people in my country starve to death? Will I ever let that happen? What use is the Government’s funds? It’s for the poor and we are committed to using it for the same. A country cannot run this way,” he told the TV channel .

The BJP seems to be gearing itself up to form a government without much clarity on what it actually needs to do on the reforms front. In all probability, India may have to adjust to subdued growth, high inflation and elevated interest rates.

)