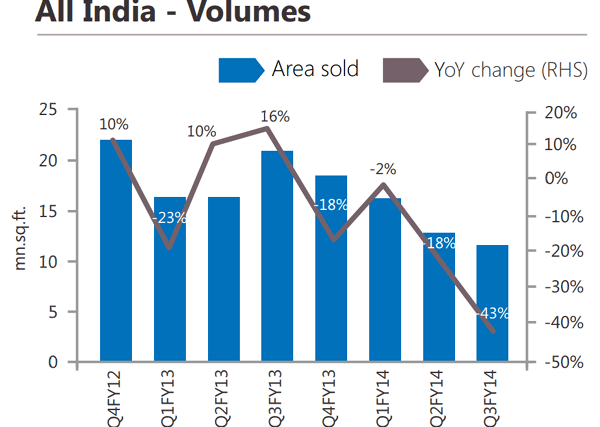

Given that it’s election year, economic urgency has taken a backseat compared to political compulsions. The economy is set to report sub-five percent growth for the second consecutive year in 2013-14, and this persistent slowdown is leading to pain in several vulnerable sectors. Nowhere more so than in real estate. Sales volumes of India’s top real estate firms have almost halved over the past eight quarters, according to a study by property consulting firm Knight Frank.

If the operating profits of realty companies have still been consistently clocking a quarterly run-rate of Rs 2,800-2,900 crore since the fourth quarter (Q4) of 2011-12 (FY12), it’s because of rising prices. “This feat could be achieved primarily on account of continuous price rise across India”, said the consultancy firm.

In the last eight quarters (from the fourth quarter of FY12 to the fourth quarter of FY14), sales volumes of at least 25 listed real estate companies have dipped 43 percent from 21.85 million sq ft to 11.80 million sq ft due to a high interest regime, unaffordable prices and an uncertain job market, thanks to the weakness in the economy.

[caption id=“attachment_80457” align=“aligncenter” width=“600”]

Data: Knight Frank[/caption]

Data: Knight Frank[/caption]

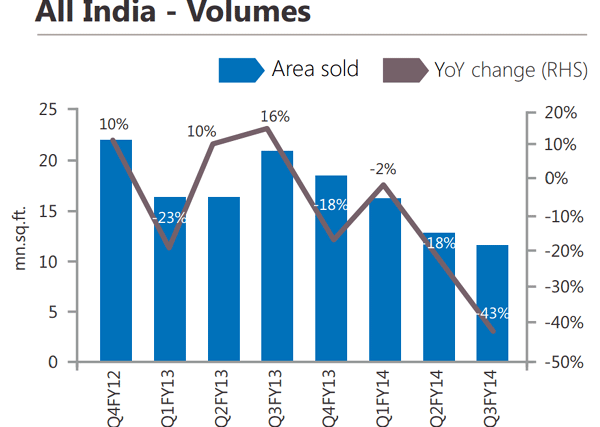

Region-wise volumes

[caption id=“attachment_80465” align=“aligncenter” width=“600”]

Source: Knight Frank[/caption]

Source: Knight Frank[/caption]

The affordable South Market: Based on sales volume, residential properties in Bengaluru and Chennai witnessed the highest growth in their market share from 16 percent in Q4FY12 to 33 percent in Q4FY14 since the South Indian real estate market is characterised by relatively affordable pricing and is usually bought by end-users rather than investors.

Highlights: SouthIndia is represented by five companies in the set of 25 real estate companies which registered a 4 percent growth in sales volumes in the last one year.

“An increase in sales volume along with an increase in revenue implies growth in construction activity. This can be

concluded by a change in prices in this region, which grew by 10 percent in Chennai and 17 percent in Bengaluru during the past eight quarters,” saidSamanthak Das, Chief Economist and Director, Research, at Knight Frank.

What worked for these companies was a relatively less leveraged balance-sheet and affordable prices.So the sales booked brought in the much needed funds to fuel the construction activity, and hence increasing revenues.

The speculative market in the North has been worst hit: The highly-speculative residential market in North India, which dominated the Indian realty market in terms of sales volumes, saw its share continuously fall from 75 percent in Q4FY12 to 51 percent in the latest quarter.

Northern India is represented by seven companies in the set of 25, and has plummeted the most in terms of sales volume by 57 percent on a year-on-year basis in Q3FY13, the data from Knight Frank showed.

A majority of the real estate majors in the North, such as DLF, have been trapped by huge debt levels, which is why they were compelled to go slow on new launches and concentrate on project completions instead, which adversely impacted the overall share of the dominant real estate region.

The rise in the gross debt levelscoupled with the increase in the cost of funds were a double whammy, which adversely impacted their net profits, which on an average fell 41 percent during the last eight quarters, while the net pro?t margins during the same period plummeted from 13.6 percent to 9.7 percent, the study showed.

One interesting fact that the report highlighted was that despite a decrease in sales volumes , revenues have been steady in the North, registering an average quarterly revenue of Rs 3,900 crore. But this is not on account of any enthusiasm shown by buyers but due to an increase in real estate prices and the developers’ focus on completing ongoing projects.

“Average residential prices in the North region have increased by 21 percent during last eight quarters,” said Das of Knight Frank. His outlook for sales volumes remains dim, compelling developers to shift their targeted milestones by at least two to four quarters.

In the West, unaffordable prices and execution risk brought sales to a grinding halt and Mumbai is the worst hit

Some 13 of the 25 listed companies are based in the West of which 10 are based in the Mumbai Metropolitan Region. Here too an oversupply of apartments, escalating prices and continuous delays in approvals have killed the sales momentum. Sales volumes in the region declined 36 percent in the last one year. Here’s where it gets even more interesting:Mumbai’s builders have registered the steepest decline in sales volume. Launches in the peripheral markets of Mumbai and Pune were the only saviours.

“During the last few years, the ban imposed on sand mining, delay in receiving environmental and forest clearances as well as other approvals have hindered construction activity here.. This is why net pro?ts for the Western India based real estate companies almost halved when compared on a Y-o-Y basis,” said Das.

Increase in cost of funds along with a delay in approvals, increased interest charges, thereby deteriorating the pro?tability of these companies. This is because an increase in interest cost directly impacts the developer’scost of servicing debt, which puts a further strain on their liquidity.

“Developers could buy time in 2009-10 to repay their debt, but a similar kind of arrangement is hard to ?nd in the current economic scenario, where there is a rise in banks’ non-performing-assets,” noted Das.

)