The BSE Sensex may have risen over 8 percent in the last one month, but the BSE FMCG index has rallied only 1.14 percent. That’s because investors are keenly aware that consumer demand has significantly decelerated across categories and not just in the discretionary space. Rural growth, which was strong in the first quarter of the current fiscal, has started to slip, while urban demand has stayed stagnant.

No wonder that a Nielsen survey recently showed that India has lost its top position in consumer confidence, slipping to third spot, below the Philippines and Indonesia. Slowing consumer demand is likely to result in the delay of purchases of households/cars and other discretionary goods. In fact, the survey further showed thatFMCG growth in urban areas had tripped to 8 percent from 17 percent last year, while in rural areas, demand growth was down to 12.2% against 21% last year.Growth in rural areas had been largely due to healthy agricultural production and government spending on the minimum price programme and the employment guarantee scheme.

In the third quarter of the current fiscal, most consumer companies still expected rural growth to drive volumes. For instance,in a conference call after its Q3 (October-December) earnings, Hindustan Unilever said, “…between rural and urban, I think the data shows that rural is doing better than urban. …[for a] couple of quarters while Asian Paints said “..rural demand continues to be better than urban demand as in previous years…”

But thisrural growth may be prone to ’tapering'.

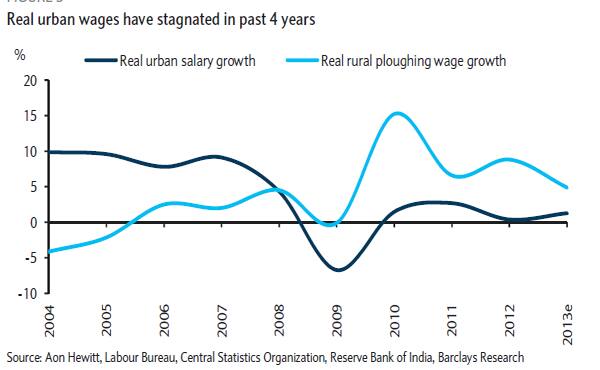

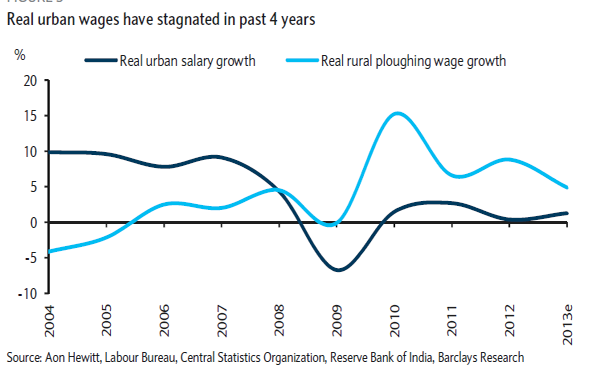

A recent Barclays report shows that rural wage growth and credit are showing signs of slowing down, an interesting development in light of the fact that the government has reduced allocation to rural employmentguarantee schemes.

Here is the chart from Barclays:

[caption id=“attachment_79728” align=“aligncenter” width=“600”]

Source: Barclays[/caption]

Source: Barclays[/caption]

Spending on rural subsidy schemes grew only 3 percent in FY14 (estimated) compared with the 16% compounded annual growth rate seen in the past nine years.

[caption id=“attachment_79729” align=“aligncenter” width=“589”]

Source:Barclays Research[/caption]

Source:Barclays Research[/caption]

Barclays also observed that there has been a shift in government spending from rural to the urban sector of late.

“The government’s policy focus has had a rural bias over the past decade. Budgeted funds for rural development during the past 10 years have been nearly 8-10 times the funds spent on urban development. Thus, while real urban wages have stagnated over the past five years, real rural wages have seen a healthy 7 percent CAGR,” it said.

The report pointed out that the allocation to the rural employment guarantee scheme has fallen 40 percent year-on- year in FY14, growth in the minimum support price (MSP) of foodgrains has slumped to 5 percent compared with the 12 percent compounded annual growth rate of the previous five years, while the real wage growth in rural areas has been less than 5 percent.

The brokerage believes the urban sector, in contrast, could witness a revival in demand as the government has started taking many measures on improving infrastructure and services. “The government is focusing on increasing subsidies for cooking gas, electricity and piped water and is also taking initiatives to improve urban infrastructure and organised sector jobs,” it said in a report.

According to the report, these initiatives could drive the growth of the sector, which is likely to contribute nearly 70-75 percent of GDP by 2020.

Barclays believes urban sector’s revival could boost urban consumption, benefiting the premium end of consumer staples.

Another brokerage, UBS, believes that well-run companies that are launching and relaunching products, such as ITC, HUL, Dabur, Marico and Emami) will gain disproportionately on an upturn in urban demand.

)