Even though Facebook has twice as many daily active users as instant messaging service provider WhatsApp, Facebook has spent a whopping $19 billion to acquire it. $4 billion in cash, $12 billion in Facebook stock and another $3 billion of stock over the next four years for good measure. This figure is 19 times more than what it paid to acquire photo sharing platform Instagram.

While there are several messaging apps, WhatsApp is the largest with 450 million active users. Its biggest appeal is the absence of ads and a measly subscription of $1 a year per subscriber and that too after one year of free usage. So from a revenue perspective, even if every single active user starts paying US$1 a year, WhatsApp will only generate $450 million in total revenue. So why was it worth $19 billion?

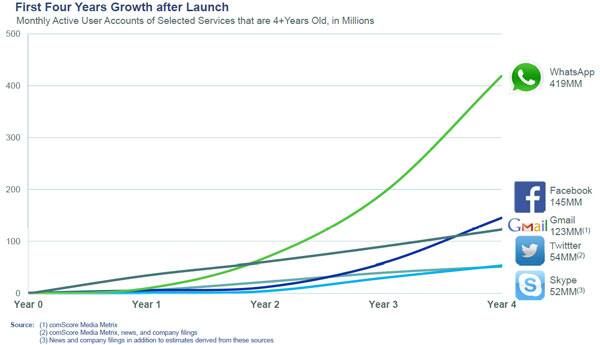

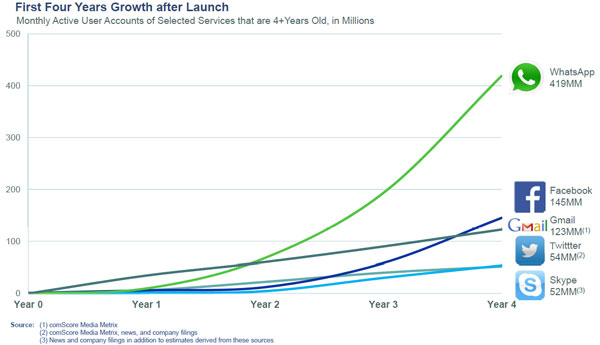

The answer lies in the numbers revealed in Facebook’s investor presentation. In the table above the numbers make a lot of sense. WhatsApp has over 450 million people using the service each month and they are growing. WhatsApp’s closest competitor, WeChat, has approximately 320 million monthly active users as of January, who are located mostly in China.

According to Facebook, 70 percent of WhatsApp users are active on the app on a given day, which shows pretty high user engagement. Also, there are more than 320 million daily active users, which is more than three times the 100 million daily active users it claimed to have in December 2012. So essentially, over 200 million of these users were added in last eight months alone.

As Firstpost noted earlier, WhatsApp is so popular that the messaging volume is now approaching the entire global telecom SMS volume, which is huge. More importantly it continues to grow at a strong pace, with nearly one million new registered users everyday.

Also, shareability is relatively high on WhatAapp. For example, WhatsApp users on an average send 600 million images each day while the volume of messages sent ranges between 20 and 24 billion.

[caption id=“attachment_77044” align=“aligncenter” width=“600”]

Whatsapp growth over the years. Photo: Facebook presentation[/caption]

Whatsapp growth over the years. Photo: Facebook presentation[/caption]

The chart above also shows that WhatsApp’s growth rate has eclipsed that of Facebook, Twitter, Skype and Gmail.

This is the kind of growth Facebook can simply not choose to ignore if it wants to remain a leader in the social networking and communication space, and the company knows it.

As Martin Belam points out in mirror.co.uk, Facebook sees “a service that is potentially eating into their audience, and purchases it.”

According to Facebook CEO Mark Zuckerberg, WhatsApp is on track to have more than a billion users, which will fuel Facebook’s mission to make the world more open and connected. Zuckerberg, in an investor call, categorically argued that when Facebook reaches three billion users world-wide, revenue opportunities will be ample and obvious.

So while Silicon Valley and WhatsApp users may be enthused by the deal, Wall Street is clearly not impressed. Facebook stock dropped 5 percent in after-hours trading. WhatsApp founders are religiously opposed to advertising and Zuckerberg has promised to remain hands-off even after the acquisition. So if not for the advertising opportunity, what else can enthuse investors?

Facebook recently admitted that it has seen a decrease in daily users specifically among younger teens. This admission caused its share price to drop 15 percent. As Geekwire points out , the WhatsApp buy could well be a “defensivemove to keep users around the world coming back to Facebook properties and Facebook-owned properties.”

Secondly, WhatsApp will feed hundreds of millions of billing accounts to Facebook. If WhatsApp will solely rely on subscription revenue,then it will have to share user data with its parent social network.

“It will be interesting to see how the two applications will be able to combine synergies in the future, because contextually they are different. What FB has not bargained for is that it could tread into unknown waters of regulation and possible action. Presently, Whatsapp’s discrete growth in connecting consumers on data networks has not been fully scrutinized and screened by several regulatory bodies internationally. With FB’s eye popping acquisition, this could bring Whatsapp into the spotlight,” said Vidya S Nath,Director, Digital Media, Global Innovation Center (GIC), Frost & Sullivan.

)