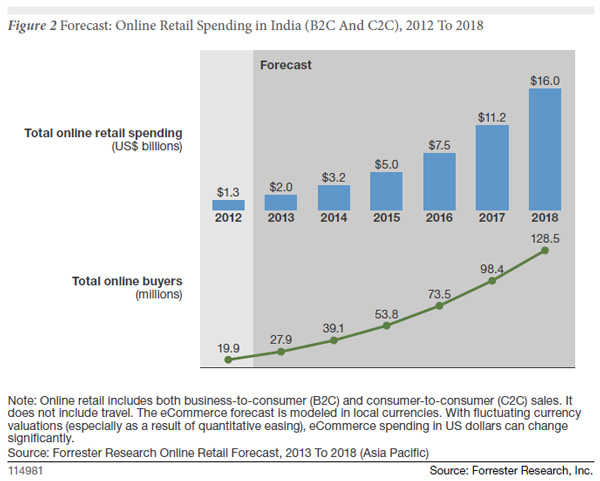

The buzz in India’s e-commerce business is getting louder by the day. Now, research firm Forrester expects India’s online retail spending to grow at a compound annual growth rate (CAGR) of more than 50 percent over the next five years and reach $16 billion by 2018, an eight-fold increase from 2013.

Online buyer population in India will grow 4-5 times in the next five years

Forrester is optimistic about the growth potential in India’s consumer base. In 2013, the country’s population was 1.28 billion with every sixth person having internet access. In other words,over 16% are onlineusers of which only 14 percent or 28 million users are online buyers. Forrester expectsthe online buyer population in India to grow to 128.5 million by 2018, which will represent 23% ofthe total online population of India in 2018.

In 2013, mobiletraffic accounted for almost 20% to 30% of their web traffic in India

Two years ago mobile traffic for several Indian online retailers was virtually non-existentbut in 2013 mobile traffic accounted for almost 20% to 30% of their web traffic in India, while mobile commerce accounted for 10% to 15% of online retailer transactions.

For instance, Flipkart reported a 20% of web traffic and 10% of sales from mobile, up from zero percent two years back.

This trend is also beingwitnessedin the travel space with online portals like MakeMyTrip.com and Yatra reporting 10% to 15% of theirtransactions through mobile in 2013

Under-penetration oforganized retail segment in tier two and tier three cities presents an opportunity for onlineretailers

Tier-II and -III cities are ripe for picking, according to Forrester. The relative absence of the organised retail segment in these markets represents an opportunity for online retailers since the so-called unorganised retail sector ( read mom & pop stores) does not have the same product selection as larger chains.

For instance, during Google’s Great Online Shopping Festival 2013, Snapdeal.com saw massive increase in sale from tier two and three cities. During GOSF 2012,snapdeal reported that 17% of sales came from tier two and the tier three cities, while in 2013 this figure was 44%.20

In a report released last week, ICICI Securities said that the organised sector represented just 16 percent of total retail salesin India in CY12 as against 85 percent in the US.

According to that report, digital buyer penetration in India is just 23.5 percent of total internet users, much lower than in developed countries like the US, where it stands at 72 percent.

Forrester suggests that Indian e-tailers continue to gain customer trust by offering high quality services like quick troubleshooting facilities, strengthening their mobile presence and engaging customers through social media.

Last week, Flipkart, India’s own Amazon, said it crossed the the $1 billion sales mark a year ahead of schedule, a proof of the high growth of the online retail space in the country. Another incident that served as evidence of investor confidence in the segment was the announcement of a Rs 830 croreinvestment in Snapdeal by a group led by eBay.

)