The Reserve Bank of India wants India’s public sector banks to opt for private sector candidates for the top jobs at these banks. However, taking up a top job at public sector wages can be quite a challenge when the basic salary on offer is one-tenth of what private-sector bank bosses earn.

According to a report in The Economic Times, the central bank is pushing for outsiders as PSU bank heads in order to introduce best practices and rejuvenate the sleepy segment while promoting fresh thinking. The big question, however, is will PSU banks agree to dole out salaries that are comparable with those in the private sector.

Sample this: The basic pay for the CEO and MD of India’s largest private sector bank Chanda Kochhar is a whopping Rs 1.52 crore in 2012-13. In stark contrast, the basic pay of SBI’s former MD and current chairman, Pratip Chaudhury, was just Rs 9.6 lakh.

While the difference between the basic pay is more than ten times, if you were to look at the total remuneration (excluding the stock options) the gap is even more jarring.

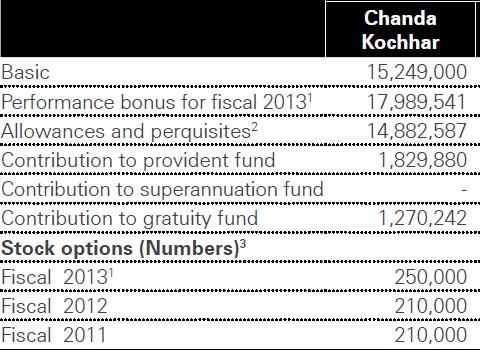

Total Remuneration of Chanda Kochhar, MD and CEO of ICICI Bank for the year 2-12-2013

[caption id=“attachment_79719” align=“aligncenter” width=“480”]  Remuneration Details of Chanda Kochhar from ICICI Bank’s annual report[/caption]

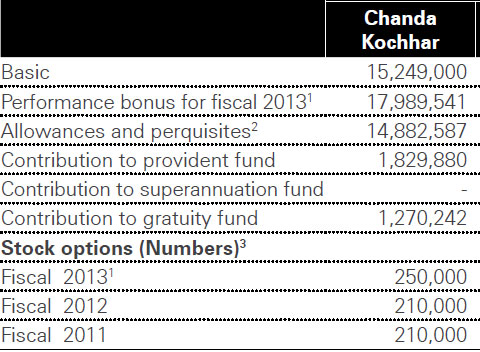

Salary and Allowances paid to Chairman Pratip Chaudhury and former SBI MD in 2012-13

[caption id=“attachment_79720” align=“aligncenter” width=“600”]  Source SBI Annual Report[/caption]

Here’s another interesting but rather contradictory fact: Recently, State Bank of India (SBI) raised salaries by 47 percent between the financial year 2011 and the December quarter of the just-ending FY14 - 67 percent higher than average salaries at the privately owned ICICI Bank, a report from IDFC Institutional Securities shows.

“While ICICI has clearly been tightening its belt, SBI’s salaries are to some extent indirectly linked to inflation in the domestic economy, preserving the employee’s purchasing power over the longer term,” the report said.

Of course, it doesn’t seem like the SBI chairman can claim that. But if state-run banks want top-flight talent, they will definitely need to offer much much more in remuneration to attract them.

)

)

)

)

)

)

)

)

)