Owning a car in India is getting expensive. And we’re not talking about car prices.

The cost of owning a car has surged in recent years because of a combination of high fuel, maintenance and loan costs.

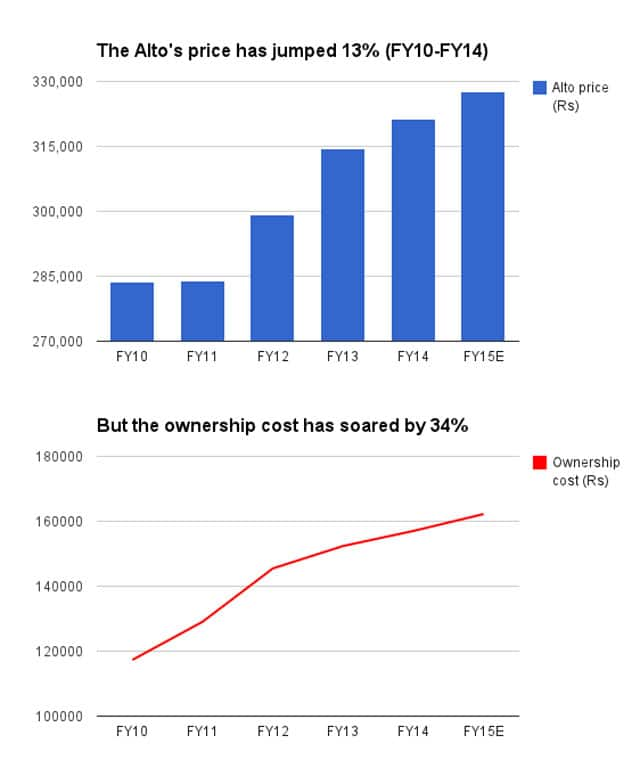

A recent Nomura report on Maruti highlights that fact by providing a break-down of the costs of owning an Alto, Maruti’s entry version car.The report notes that while the cost (on-road) of an Alto has increased about 13 percent between FY10 and Fy14, the cost of actually owning a car has risen by a steep 34 percent (See chart below. Source data: Nomura report)

In fact, if you take a look at the table towards the end of this story, you’ll see that the total ownership cost (annual) is almost 50 percent of the cost of buying the car in FY14.

That is because the individual components of the total cost of owning a car have surged over that time period.The cost components included in Nomura’s calculation are fuel, maintenance , insurance and loan payments.

[caption id=“attachment_82603” align=“aligncenter” width=“640”]  Chart[/caption]

The fuel cost, for instance, has jumped by a little more than 50 percent between FY10 and FY14, while the maintenance cost has soared 46 percent.

Annual loan costs have also risen - by around 23 percent. That is based on the assumption that interest costs on a five-year car loan have expanded from 9.5 percent in FY10 to13 percent by FY14. Buyers predominantly avail an auto loan to buy a car in India. In addition, annual insurance costs have climbed by 13 percent, according to the report.

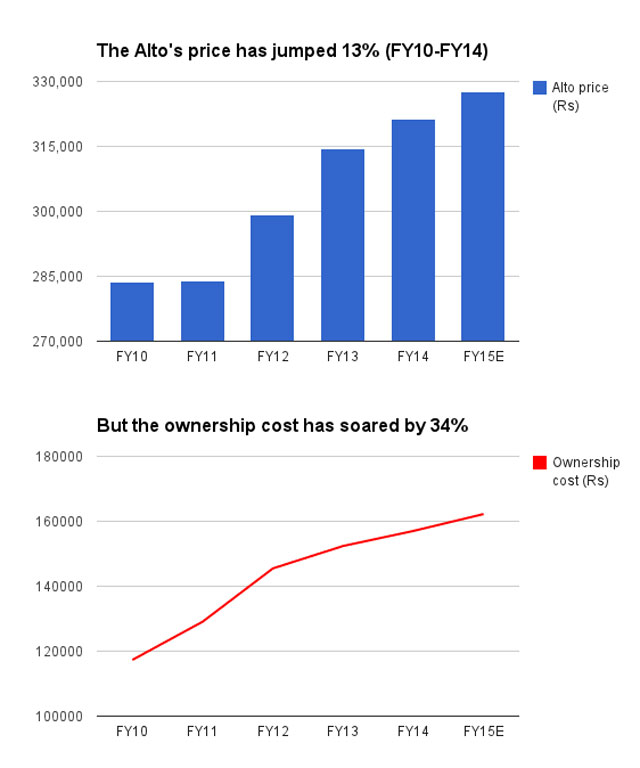

Check out the breakup of owning a car below

[caption id=“attachment_82604” align=“aligncenter” width=“600”]  Source: Nomura[/caption]

And here’s a final thought: if the cost of owning an entry-level car has jumped by more than one-third, how much higher have the costs of higher-end cars climbed?

Don’t hold your breath waiting for a turnaround in the situation. With Brent crude closing in the $110 per barrel mark, fuel prices are not going to cool down in the near future. Given the persistent threats to inflation, interest rates are unlikely to be lowered significantly either.

Something to think about if you’re planning on buying a car.

(Please note: The figures for FY14 and FY15 are estimates.)

)

)

)

)

)

)

)

)

)