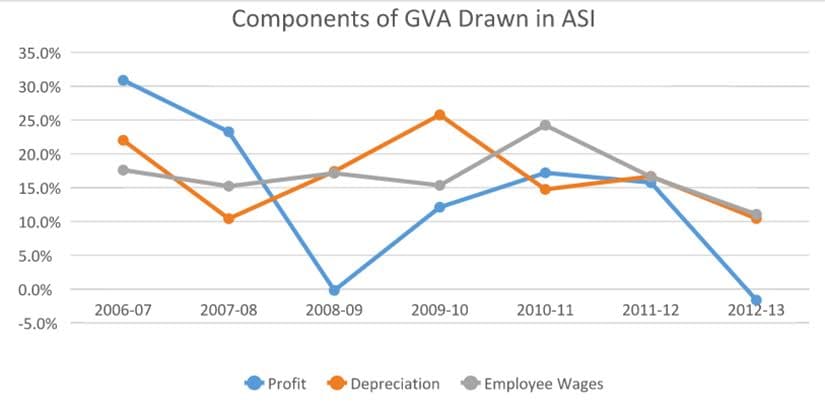

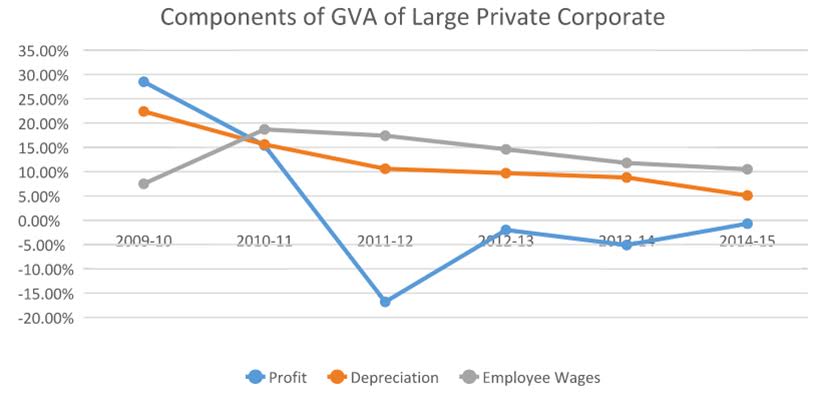

Currently, India’s stated 7% plus real GDP growth stands as a beacon in growth-starved world. However, one has to wait another few days to figure out whether the number is maintained or not. This is because, the revised GDP estimates of 2014-15 and first half of 2015-16 are expected to be published in February. Downward revision of nominal GDP? The author has previously expressed concern of the choice of base year (2011-12) in the new series of GDP, while fully acknowledging that per se the new methodology has no issues. [caption id=“attachment_2588252” align=“alignleft” width=“380”]  Reuters[/caption] A significant portion of the GDP estimate depends on estimates/ projections based on National Sample Surveys(NSS) (conducted every five years) or annual surveys such as Annual Survey of Industries (ASI) whose results are available with a lag of two years. Such data shortcomings are neither new nor unique to India. With the benefit of hindsight one may comment that 2011-12 base year would have reasonable choice for a base year, had the downturn not started in FY13. The GDP estimates for 2014-15 and first half of 2015-16 GDP have components which are based on statistical projections based on NSS 2011 and ASI 2011-12. Additionally, the deteriorating 2014-15 corporate performance from MCA21 (Ministry of Corporate Affairs) data base have not been incorporated in 2014-15 GDP estimation (published in May 2015), since the MCA data comes with a lag of 8-9 months. However, when the revised GDP estimates are published in February 2016, ASI 12-13, MCA FY15 data and other updated data will be used to re-estimate the GDP. How bad may be the revised numbers? A look at the growth rate of critical components of GVA in ASI shows that the growth rates of these components has fallen significantly in 2012-13 over 2011-12 and are well below long-term trends.  Data for ASI 2013-14 is yet to be released, but large corporate data drawn from the RBI’s study of private corporate tend to show a sharp deterioration from 2012-13.  As more recent but deteriorating numbers are used to estimate the nominal GDP, it may be revised downward. However the entire downward revision may not happen in the first revision due in February 2016. A more complete picture of 2014-15 GDP is likely to emerge in the second revision due in 2017. As such the nominal GDP growth rate of 10.5% observed in 2014-15 may ultimately be shaved off by 0.5-1.5%. If the GDP deflator for the period remains unchanged, then the real GDP for 2014-15 may turn out to be in the range of 5.9% to 6.9%. The deflator dilemma The Mid-Year Economic Analysis 2016 (MYEA-2016) explains at length the issues of negative GDP deflator (-1.4% for the second quarter 2015-16) and possible adverse economic implications of decade low nominal GDP growth. However, the RBI’s Financial Stability Report (FSR) published around the same time does not even mention the word ‘deflator’ nor a word of weak nominal GDP growth. This is surprising for a banking regulator, since a falling nominal GDP growth may have adverse implication for debt servicing ability of corporates. The negative GDP deflator (for Q2 FY16) actually ‘inflated’ the nominal GDP of 6% to a real GDP of 7.4%. Not exactly the sign of an economy in the prime of health. One may be forgiven for imagining that possibly the RBI does not believe that the GDP deflator is negative. However, such thinking may not be baseless. The the mid-year economic review expressed some doubt on the aspect that producer services (accounting for 20% of GVA) is deflated by WPI. The WPI for last 13 months has negative growth. Thus the producer services component’s real growth was actually inflated over the nominal growth rate. There may be an argument that the CPI may be the more realistic approach to deflate the producer services component. Since CPI growth is around 5%, if the said adjustment is made then the GDP deflator for the second quarter of 2015-16 will actually become a positive number. Since the nominal GDP growth for the quarter was 6%, a positive GDP deflator would mean that the real GDP growth is actually below 6%. In Conclusion, if one does not believe in the deflation issue (negative GDP deflator) then one has to logically believe is sub 6% growth, which means that the economy is not in recovery mode. But then it is possible that when the GDP figures are revised in February 2016, the nominal GDP growth rates of FY15 (10.5%) and the first half of 2015-16 (7.4 percent) may get revised downward. Thus the real growth may come down. The deflator mechanism is unlikely to be changed in a hurry. A market banking heavily on the outlier Indian growth rate may get a rude shock. The author is a visiting faculty at IIM Calcutta and a financial services professional

Currently, India’s stated 7% plus real GDP growth stands as a beacon in growth-starved world. However, one has to wait another few days to figure out whether the number is maintained or not. This is because, the revised GDP estimates of 2014-15 and first half of 2015-16 are expected to be published in February. Downward revision of nominal GDP? The author has previously expressed concern of the choice of base year (2011-12) in the new series of GDP, while fully acknowledging that per se the new methodology has no issues.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)