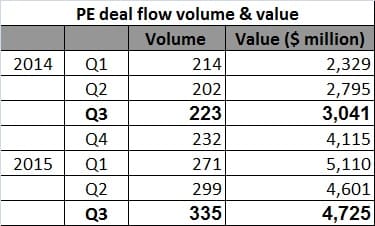

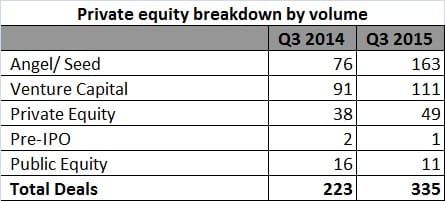

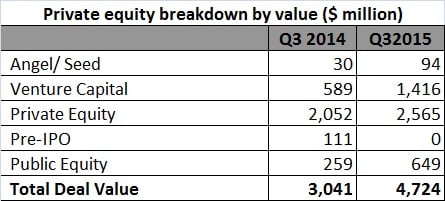

India has witnessed a record high inflow of private equity funds during the first nine months of 2015 making the country the fastest growing start-up ecosystem in the world and Mumbai the hotbed for M&A and private equity activity in the country, said a report by VCCEdge, the financial research platform of the VCCircle Network. [caption id=“attachment_2030177” align=“alignleft” width=“380”]  Thinkstock image[/caption] Inflow into the country during January-September stood at $14.24 billion, 32 percent higher than the previous high of $10.74 billion witnessed during the first nine months of 2008 and 72 percent higher than the $8.3 billion invested during the same period in 2014. Deal volume too hit an all-time high of 928 during the nine-month period. According to the report, during July-September alone private equity firms invested $4.7 billion across 342 deals, up 53 percent on year. Of this, 61 percent were big-ticket deals ($100 million and above).  Consumer discretionary, financials, information technology, health care and utilities were the top five sectors to attract significant private equity capital during the quarter. Meanwhile, exits declined by half to 37 deals from 73 deals in the year ago quarter. Deal value spiralled 62 percent lower to $487 million from $1.29 billion during the same period.  Angel and seed investments into the country grew 3-fold to $94 million during the quarter from $30 million a year ago. Deal volume saw more than two-fold increase to 166 deals from 77 deals during the period. Venture capital firms invested $1.42 billion in 114 deals during the quarter, up from just $590 million in 91 deals a quarter ago.  Deal volume declined across domestic and cross-border M&A deals, with inbound deals falling the steepest - 19 percent. M&A deal value grew nearly 31 percent, the growth being driven by outbound deals, the report said.

Venture capital firms invested $1.42 billion in 114 deals during the quarter, up from just $590 million in 91 deals a quarter ago.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)