The stocks of Jubilant Foodworks fell 8 percent today after JP Morgan initiated coverage on the stock with an “Underweight” rating.

Jubilant, which owns the franchise for Dominos Pizza and Dunkin Donuts, is the only quick service restaurant chain listed in India. No doubt it has tremendous opportunities of growth. But JP Morgan says the valuations have caught up with the growth and any slip now from expectations will mean punishment for the stock. The stock is trending at 51 times the expected earnings for financial year 2013 at Rs 1,233. The research firm has a target price of Rs 990.

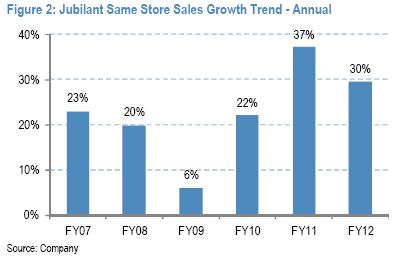

The same sales growth in the company might suffer as though Jubilant has a first mover advantage in the pizza delivery segment, Pizza Hut is also upping its ante, as it aims to have 350+ Pizza Hut stores with delivery format by 2015 and 700+ by 2020.

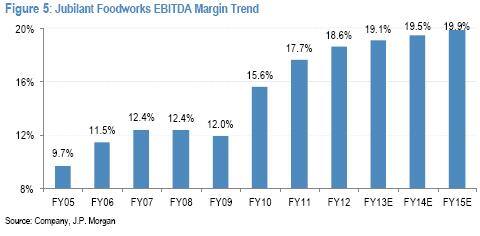

Jubilant’s operating margins have grown by 60 bps (100 bps=1 percent) over the past five years. But with high labour costs and rising competitive spends, the margins could shrink or stagnate over next few years. Any dip in margin will be negative for the valuations of Jubilant.

Its advertising and publicity spends should move up given company’s desire to

grow volumes in an increasingly more value driven and competitive

environment. JP Morgan says, “Advertising spends as percentage of sale have risen from 4 percent in 2010 to 4.2 percent in 2012. We estimate this to move up to 4.6 percent by FY15.”

Impact Shorts

More ShortsAt 51 times the expected earnings in 2012-13, the stock is trading at 90 percent premium to the consumer universe in India. JP Morgan uses the multiple of 30 times to expected earnings of 2014 and reaches at a target price of Rs 995. This means almost a 20 percent downside from the current levels.

)