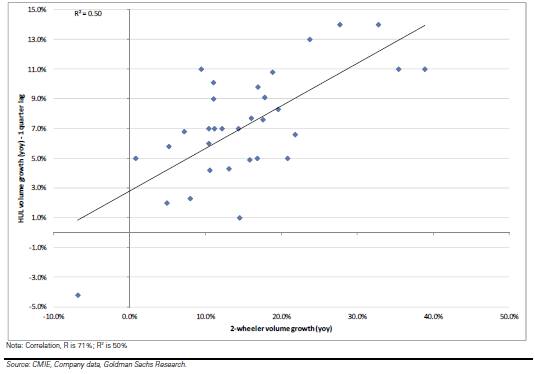

A recent Goldman Sachs report, which suggests a strong correlation between the performance of FMCG major Hindustan Unilever and that of the two-wheeler industry, has pointed out that slowdown in sales of scooters and motorcycles portends negatives for Hindustan Unilever Ltd (HUL), apparently with a quarter’s lag.

“Two-wheeler year-on-year volume growth for the third and fourth quarters of 2012-13 at 0.8 percent and (-)1.3 percent, respectively, are significantly below the past 10-year average of 11.7 percent. Likewise, HUL’s volumes in 3QFY13 were the lowest in the past three years at 5 percent, also below the 10-year historical average of 7 percent,” the report said.

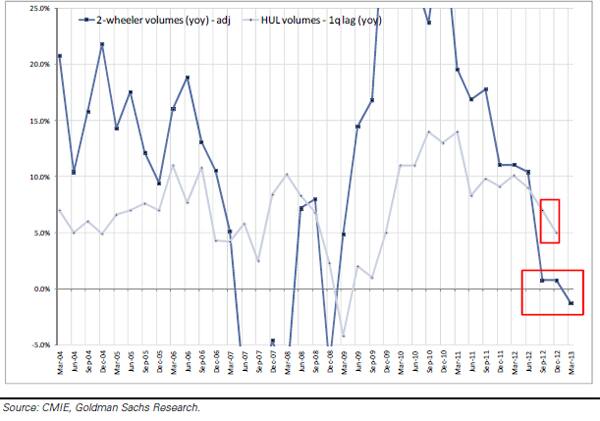

[caption id=“attachment_706094” align=“alignleft” width=“535”] Two-wheeler volume growth (yoy) vs HUL’s volume growth with a lag (yoy) since March 2004[/caption]

Two-wheeler volume growth (yoy) vs HUL’s volume growth with a lag (yoy) since March 2004[/caption]

Domestic two-wheeler sales for fiscal year 2013 were a mere 2.9 percent after growth at over 20 percent in FY10 and FY11 and 14 percent in FY12. According to this Mint report, the growth will remain subdued for the next three to five years as India is getting close to peak penetration levels.

“Once a threshold of adequate penetration of two-wheelers is attained, aspirations for owning a passenger car lead to a slowing down of two-wheeler growth rates. The price of an entry-level car is around eight times that of low-end motorcycles in China. It is about five-six times in India, it said, quoting a Macquarie report.

Two-wheeler volumes have been significantly below trend

[caption id=“attachment_706118” align=“alignleft” width=“600”] 2-wheeler quarterly domestic volumes (yoy, adjusted for shifts in the festive season) and HUL

2-wheeler quarterly domestic volumes (yoy, adjusted for shifts in the festive season) and HUL

volume growth (yoy)[/caption]

Impact Shorts

More ShortsInvestors are already concerned about the slowing growth in volumes due to tapering of price-led growth seen in soaps and detergents and demand pressures witnessed in personal care products, namely skincare and haircare in premium category. And this is why perhaps HUL has been offering priceoffs on its premium detergent brand Surf Excel Matic.

“HUL’s revenue is expected to grow by 11-12 percent (Y-o-Y), which would be driven by 5-6 percent volume growth. Some moderation could be witnessed in discretionary spends like foods and personal care. Sales growth in soaps and detergents could be under pressure due to muted volume performance,” said HDFC in its Q4 earnings preview.

While gross profit margin is expected to improve on account of reduction in palm oil prices and earlier price hikes, the impact may be mitigated by higher adspends and increase in royalty.

)