No surprises here. The three months till March have been pretty gloomy for companies in terms of sales and profits.

According to Crisil Research’s analysis of the financial performance of 227 companies across 26 industries (excluding banks and oil companies) for the quarter ending March, Ebitda (earnings before interest, taxes, depreciation and ammortisation) or operating profit margins will decline by 200-250 basis points because of slower volume growth, high input costs and limited pricing flexibility. (100 basis points = 1 percentage point.)

Still, Ebitda margins will be marginally better from the previous quarter because of the season effect, the research agency said in a press release. At the net profit level, the pressure is expected to be even more acute. Net margins are likely to show an even sharper decline from the 12.7 percent reported a year earlier because of higher interest costs.

[caption id=“attachment_258432” align=“alignleft” width=“380” caption=“Driven by an increase in prices and higher volumes, cement companies are expected to report an 18 percent growth in revenues.”]

[/caption]

[/caption]

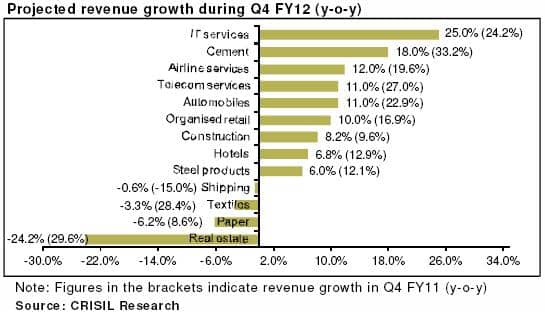

Revenue growth is also expected to be subdued, at around 15 percent, compared with the 25.5 percent growth reported in the December-ending quarter. That is primarily due to a slowdown in consumption growth and sluggish investment activity in an uncertain global environment.

“Corporate India continues to feel the pinch of demand moderation, higher input costs and lack of pricing power,” said Mukesh Agarwal, senior director at Crisil Research in the release. “Based on an analysis of the aggregate financial performance of 227 companies across 26 industries (excluding banks and oil companies), Crisil Research anticipates a 200-250 bps decline in EBITDA margins in Q4FY12 (January-March) from 22 per cent in Q4FY11. Net margins are likely to decline even more sharply from the 12.7 per cent reported in Q4FY11 due to higher interest costs.”

Impact Shorts

More ShortsOn the sector front, cement, IT and telecom service providers are expected to outperform. Driven by an increase in prices and higher volumes, cement companies are expected to report an 18 percent growth in revenues, while IT service providers are expected to report strong revenue growth of around 25 percent due to an increase in offshore volumes and rupee depreciation.

In contrast, “during Q4FY12, we anticipate a sharp drop of 400-800 basis points year-on-year in margins for players in airlines, aluminium, hotels, cotton yarn, and manmade fibres sectors, mainly due to slower volume growth and high raw material and wage costs. EBITDA margins for auto and auto component makers, steel, and paper manufacturers even are likely to decline by 100-300 basis points,” it said.

Read the Crisil release here.

)