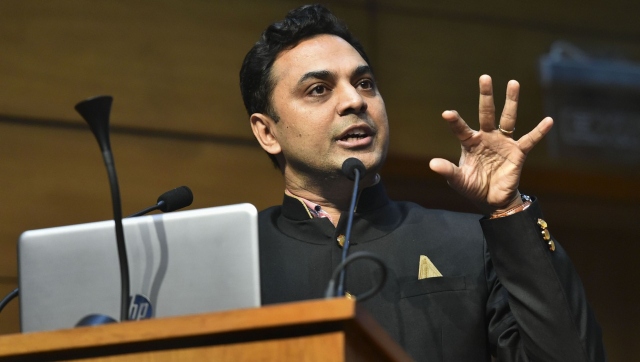

Chief Economic Adviser KV Subramanian has made a strong case for setting up of a bad bank led by private sector to effectively deal with non-performing assets of the financial sector which may see a surge once regulatory forbearance to deal with the impact of COVID-19 is withdrawn. The proposal to set up a bad bank has been under consideration of the government for long and some steps may be announced in the Budget 2021-22 to be unveiled by Finance Minister Nirmala Sitharaman on Monday in the Lok Sabha. Bad bank refers to a financial institution which takes over bad assets of lenders and undertakes resolution. Lenders have been making a case for setting up a bad bank to ease out pressure of bad loans on them in these difficult times. “The bad bank will certainly help in consolidating some of the non performing assets. It’s important to also think about implementing the bad bank in the private sector that enables (faster) decision making,” he told PTI in an interview. Resolution of bad assets with alacrity in decision making often in the public sector is impacted because of the fear of 3Cs, he said. 3Cs refer to Central Bureau of Investigation (CBI), Central Vigilance Commission (CVC) and Comptroller and Audit General (CAG). “So, the bad bank idea itself is actually something which is required at this point in time, but also designing it in the private sector actually has a lot more possibility for it to be effective,” he said. The Economic Survey 2017 had proposed this idea, suggesting the creation of a bad bank called Public Sector Asset Rehabilitation Agency (PARA) to help tide over the problem of stressed assets. Earlier this month, RBI Governor Shaktikanta Das indicated that the central bank can consider the idea of a bad bank to tackle non-performing assets (NPAs). “If there’s a proposal to set up a bad bank, the RBI will look at it. We have regulatory guidelines for asset reconstruction companies,” Das had said. Subramanian, the lead author of the Economic Survey 2020-21, has made a case for carrying out a fresh asset quality review (AQR) once the ongoing forbearances related to COVID-19 come to an end. Any AQR exercise, the Survey said, must be accompanied by a round of bank recapitalisation. Elaborating on the AQR exercise, he said that it amounts to recognising something bad that is cosmetically covered up. “But the important message that is being made is that AQR has to be done. When AQR is done, the estimation or unearthing of bad assets actually has to be done well,” he said. The government must get rid of the forbearance window, provided by banks to borrowers due to COVID-19 induced economic challenges, as soon as the economy starts to revive as it is only an “emergency medicine” and not a “staple diet”, the Survey suggested. Financial regulators across the globe adopted the regulatory forbearance measures to tide over the economic challenges posed by COVID-19 and India was no expectation. Once the forbearance policy was discontinued in 2015, the RBI conducted an AQR to know the exact amount of bad loans present in the banking system. As a result, banks’ disclosed NPAs increased significantly from 2014-15 to 2015-16. In the absence of forbearance, banks preferred disclosing NPAs to the restructuring of loans.

A bad bank is a financial institution that takes over bad assets of lenders and undertakes resolution. Lenders have been making a case for a bad bank to ease pressure of bad loans in these difficult times

Advertisement

End of Article

)

)

)

)

)

)

)

)

)