New Delhi: Air India had formulated a plan to monetise assets worth Rs 5,000 crore by 2016 but not a single property identified for sale under this plan had yet been sold. A civil aviation ministry official said today the Union cabinet has finally approved sale of four flats which the airline owned on Peddar Road, Mumbai for about Rs 90 crore.[caption id=“attachment_2512200” align=“alignleft” width=“380”]

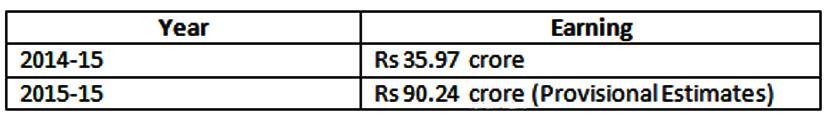

In financial turmoil. Reuters[/caption] And another small property worth about Rs 19 crore in Coimbatore may also soon get the Cabinet’s nod for selling. But proposals for two other properties, at Chennai and Kolkata, are not even ready for the Cabinet. And the mega assets – properties in Vasant Vihar and Baba Kharak Singh Marg in Delhi – are mired in problems such as legal issues over title deeds and ownership issues. The asset monetisation plan had envisaged Air India raising Rs 1,200 crore in 2013-14, Rs 2,000 crore in 2014-15 and Rs 1,800 crore in 2015-16. It remains on paper as of now. Air India is surviving on Rs 30,000 crore bailout package from the government; its debt stands at over Rs 50,000 crore and accumulated loses at over Rs 36,000 crore. Property monetisation would have helped reduce its debt burden. As per Turn Around Plan/Financial Restructuring Plan approved by the Cabinet Committee on Economic Affairs (CCEA), Air India is required to monetise its assets and generate Rs 5,000 crore by way of sale, leasing or developing an asset as a joint venture. Specific approval of the cabinet is necessary for each case of sale or long term lease of land belonging to the government or government-controlled statutory authorities as per the instructions laid by Ministry of Finance. Air India has been in possession of some properties which are lying vacant and unused for a long time because of shifting of its offices to airport terminal buildings, city location and also as a result of stopping of its operation from such locations etc. Monetising such properties by way of sale/rent or to develop as a joint venture, to raise non operating revenue, would help the company to retire its huge debts. According to a written reply by Minister of State for Civil Aviation, Mahesh Sharma, in Rajya Sabha during the Monsoon Session, the government has received proposals for monetisation of following properties from Air India: 1. Residential plot measuring 0.99 acres approx. at Pankaja Mill, Road, Coimbatore 2. Residential cum commercial Plot of Land measuring 1.33 acres approx. at Mount Road, Teynampet, Chennai. 3. Four Flats measuring 2033 sq. ft. approx at Sterling Apartment, Mumbai. At that time, the minister had said that the government has drafted these proposals for the approval of the cabinet. Besides, Air India has approached government/public sector undertakings such as Income Tax Department, Service Tax Department, State Bank of India etc. for leasing space in its office building at Nariman Point, Mumbai. The details of earnings of Air India from monetisation of assets are as under:

In financial turmoil. Reuters[/caption] And another small property worth about Rs 19 crore in Coimbatore may also soon get the Cabinet’s nod for selling. But proposals for two other properties, at Chennai and Kolkata, are not even ready for the Cabinet. And the mega assets – properties in Vasant Vihar and Baba Kharak Singh Marg in Delhi – are mired in problems such as legal issues over title deeds and ownership issues. The asset monetisation plan had envisaged Air India raising Rs 1,200 crore in 2013-14, Rs 2,000 crore in 2014-15 and Rs 1,800 crore in 2015-16. It remains on paper as of now. Air India is surviving on Rs 30,000 crore bailout package from the government; its debt stands at over Rs 50,000 crore and accumulated loses at over Rs 36,000 crore. Property monetisation would have helped reduce its debt burden. As per Turn Around Plan/Financial Restructuring Plan approved by the Cabinet Committee on Economic Affairs (CCEA), Air India is required to monetise its assets and generate Rs 5,000 crore by way of sale, leasing or developing an asset as a joint venture. Specific approval of the cabinet is necessary for each case of sale or long term lease of land belonging to the government or government-controlled statutory authorities as per the instructions laid by Ministry of Finance. Air India has been in possession of some properties which are lying vacant and unused for a long time because of shifting of its offices to airport terminal buildings, city location and also as a result of stopping of its operation from such locations etc. Monetising such properties by way of sale/rent or to develop as a joint venture, to raise non operating revenue, would help the company to retire its huge debts. According to a written reply by Minister of State for Civil Aviation, Mahesh Sharma, in Rajya Sabha during the Monsoon Session, the government has received proposals for monetisation of following properties from Air India: 1. Residential plot measuring 0.99 acres approx. at Pankaja Mill, Road, Coimbatore 2. Residential cum commercial Plot of Land measuring 1.33 acres approx. at Mount Road, Teynampet, Chennai. 3. Four Flats measuring 2033 sq. ft. approx at Sterling Apartment, Mumbai. At that time, the minister had said that the government has drafted these proposals for the approval of the cabinet. Besides, Air India has approached government/public sector undertakings such as Income Tax Department, Service Tax Department, State Bank of India etc. for leasing space in its office building at Nariman Point, Mumbai. The details of earnings of Air India from monetisation of assets are as under:

Cabinet nod for Mumbai property sale but Air India way behind monetisation target

Sindhu Bhattacharya

• November 18, 2015, 18:34:46 IST

Air India is surviving on Rs 30,000 crore bailout package from the government; its debt stands at over Rs 50,000 crore and accumulated loses at over Rs 36,000 crore.

Advertisement

)

End of Article