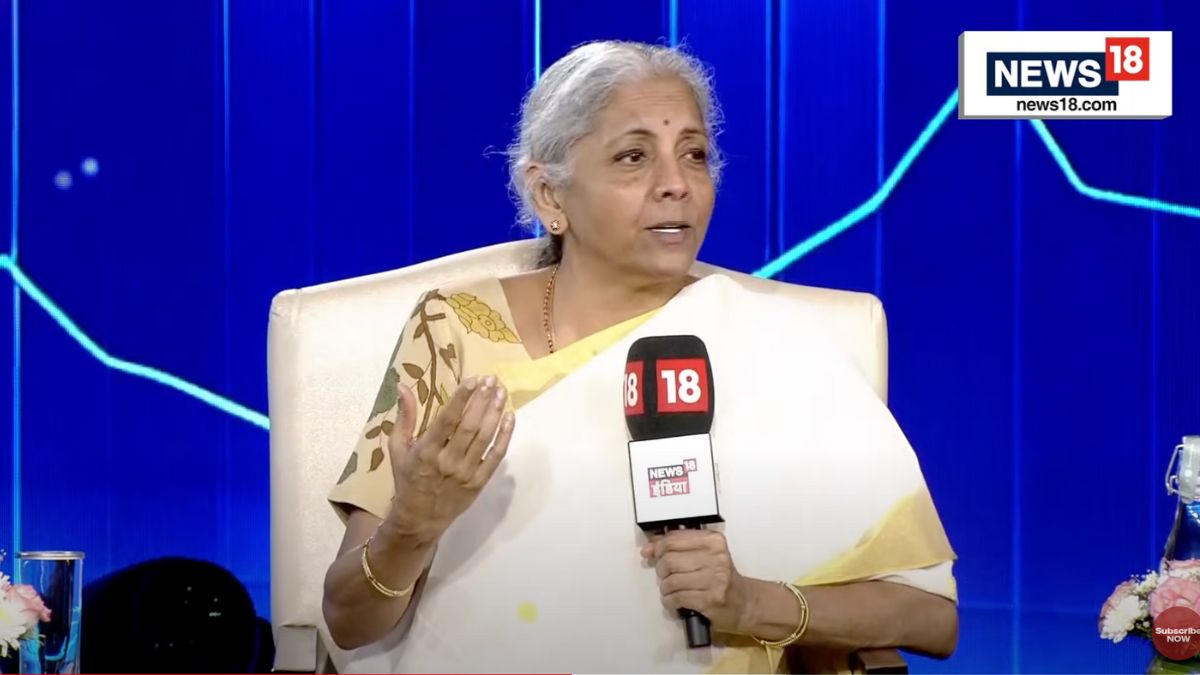

Finance Minister Nirmala Sitharaman is scheduled to present the Union Budget 2025 in the Lok Sabha on 1 February 2025. This will be the finance minister’s eighth budget (including interim budgets) and industry stakeholders, investors and the entire country, are expecting a slew of measures to be announced, especially considering the health of the rupee, rising middle class costs and a general impression of stagnation of growth in the economy.

The Budget expectations can broadly be divided into three major buckets – for the overall development of the economy, ease of doing business for the industry and re-look at duty rates / exemptions for various goods and services.

The overall development of infrastructure needs in the country has progressed steadily since the turn of the decade in 2020. There has been initiation of infrastructure corridors, PLI schemes to promote domestic manufacturing, and other schemes to alleviate general industry growth. Two prominent expectations this time feature around the MOOWR scheme [Manufacturing in Warehouse Scheme] under Customs laws, and as always, streamlining or new / re-introduction of PLI schemes.

The MOOWR scheme provides impetus to domestic manufacturing and offers exemption/deferment of duty applicable on capital goods and inputs at the time of import. A significant proposed change in the MOOWR scheme (although not in effect) is goods can be imported under the MOOWR scheme, provided that the applicable Integrated GST (IGST) are paid at the time of import. While IGST is creditable, upfront payment of IGST can affect working capital. Thus, the new provision should continue to be in abeyance for fulfilment of the Make in India vision of the government.

With respect to PLI schemes, there have been graded success since their introduction. Teething problems exist especially in areas of procedural compliance under domestic value addition, inordinately strict certification and disbursement of incentives. PLI schemes should be re-looked into to streamline processes, especially where compliance and certification is stringent, and issues of disbursement to ensure further success of the schemes. New schemes favouring sunshine sectors [growth of MSME(s), manufacturing of EV passenger cars] where there is active potential to increase and incentivize manufacturing, should also be considered.

Impact Shorts

More ShortsEase of doing business is a phrase that is heard today in all corridors with somewhat staggered practical implementation. The amnesty scheme for pending Customs cases has been ask now for almost three Budget speeches with little traction from the Government. Automation of Customs gateways and introduction of advanced technological processes, especially in ICEGATE, to streamline with other online functions, are another definitive ask. The government should now give serious thought to implementing such measures (especially the Customs amnesty scheme) to alleviate the needs of the industry. The Special Valuation Branch process of Customs is in the need of serious overhaul as SVB cases go way beyond the prescribed SOP(s) and linger on for many years mainly due to the apathy of the Branch officers. New SOP(s) including proper furnishing of investigation reports to all stakeholders is a serious need of the hour. Another significant ask is the extension of FTA benefits (available for normal imports) to clearance(s) from SEZ(s) to Domestic Tariff Area [where the goods are eligible for FTA benefit] and the same should also be seriously considered. Payment of IGST as a duty of customs, social welfare surcharge etc. through duty credit scrips should also be considered.

Ease of doing business should also be extended by issuing clarifications on contentious issues. For example, permanent transfer of intangibles like intellectual property, carbon credits etc. are considered a supply of goods. However, for export and import of goods, the GST laws prescribe physical movement of goods into / outside India. There should be enabling provisions for such intangibles (where physical movement is impossible) which relinquish the requirement of physical movement and instead depend on transfer of title. This would enable export benefits to be available for domestic suppliers. Similarly, for imports, similar provisions like reverse charge payment (like import of services) should be made the norm. Payment of GST The Government has to remember that “ease of doing business”. Setting up captive data centres, and global support centres in India have recently gained traction. These centres primarily indulge in export of service getting in significant foreign exchange into India. Excluding Net Foreign Exchange considerations for them (if set up in SEZ and STPI) like IFSC units and enabling payment of any domestic GST applicable on import of service, through input tax credit (as opposed to payment in cash), could be a significant growth enabler for this sector.

A conversation on the re-look of duty rates / rationalization of tariff must always start on duty structures. There are many goods where the import of finished goods is subject to NIL duty (either by tariff or through FTA) whereas import of raw material for domestic manufacture is subject to applicable customs duties. There needs to be consultation with industry to promote domestic manufacture, where the import of raw material should be incentivised to NIL or very low rates of duty, and the import of finished goods subject to higher rates of duty. This would also stop the flooding of the domestic market with cheap sub-standard imports of finished goods from neighbouring countries and promote domestic manufacturing, especially among small industries.

Other rate rationalisation measures should include the conversation around uniform GST slabs where biscuits and confectionary should not be treated to the same GST rates as certain kinds of tyres and the middle class is spared from unrealistic GST payments on household goods. The proposal to reduce GST on medical insurance to 5% should be really implemented. Other measures should include clarifications and comprehensive lists issued to simplify classification of certain telecom and IT goods [where goods – merely because they talk about certain technology (like LTE etc.) are denied applicable customs duty exemptions as the authorities deem them to be complete machines having access to technology, even when they are imported as “parts”. This would be in line with Supreme Court judgments striking down this interpretation of the Customs authorities.

An eighth Budget is almost the end of the tether where the trend has been speculative and hit and miss policy decisions without any practical implementation to alleviate the economy. Time has come to really understand the needs of the Indian industry, economy and domestic households and make practical decisions which could truly help in ease of doing business instead proposals ending up as incomplete lip service after a few months.

Rajat Bose is Partner and Neeladri C is Consultant – Shardul Amarchand Mangaldas and Co. Views expressed in the above piece are personal and solely those of the author. They do not necessarily reflect Firstpost’s views.

)

)

)

)

)

)

)

)

)