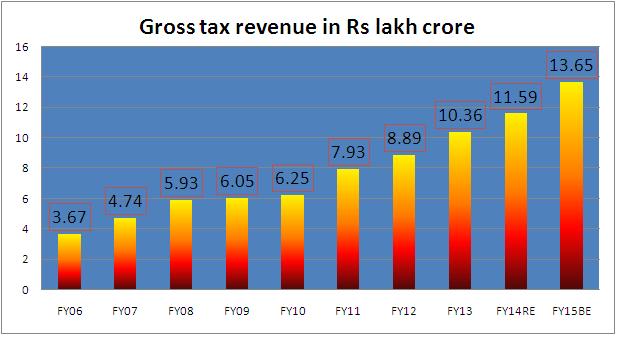

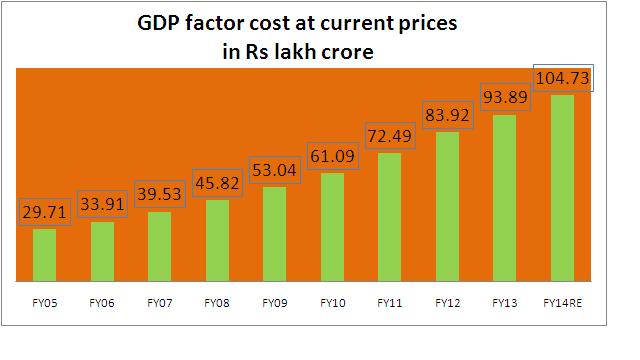

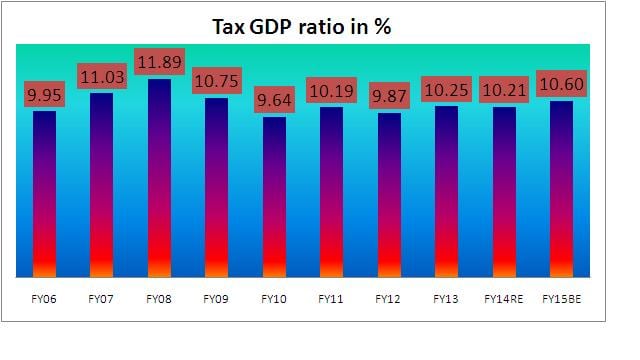

By Rajesh Pandathil & Kishor Kadam An analysis of the government’s tax revenue growth and GDP growth over the last 10 years shows that tax evasion has been rampant in India and the government should take urgent steps to address this issue. In the last 10 years, under the United Progressive Alliance, Indian economy had some of the best growth years, due to various reasons, including the scorching pace of growth the global economy witnessed during the pre-crisis years. The tax revenue growth during the period, however, has not been as robust as it should have been. [caption id=“attachment_2121023” align=“alignleft” width=“380”]  ThinkStock[/caption] As per the graphic below, the government’s total tax revenue has grown from just Rs 3.57 lakh crore in 2005-06 to Rs 13.6 lakh crore estimated in 2014-15. On an average, the growth over the period has been 16.4 percent annually. Meanwhile, gross domestic product of the country at factor cost at current prices grew from Rs 26.26 lakh crore in 2005-06 to Rs 104.73 lakh crore, marking an average annual growth of 14.85 percent. Tax revenue usually grows faster than GDP. But the growth that India witnessed during the period is far from satisfactory, given the growth in tax revenue has been just 1.55 percentage points higher than the GDP growth. Though one cannot say how much should the tax revenue growth be in an ideal situation, the growth that India has seen is definitely low, indicating rampant evasion.   But, to be sure, evasion is not the only reason for lower tax revenue growth. There are many sectors that get exemptions and are not getting taxed adequately, like agriculture. This also must have contributed to subdued tax revenue growth.  Another number that could explain the shoddy tax compliance is the tax to GDP ratio. According to Investopoedia, a higher ratio means the government’s tax revenue is adequate to cover some of its deficiencies. Lower ratio means tax revenue growth is slower. India has a low tax-to-GDP ratio of about 10-11 percent, as the graphic below shows. The highest that the country attained over the last 10 years or so was in 2007-08 at 11.89 percent. For the current year, the ratio is pegged at 10.60 percent. Now compare this ratio with the global average of about 14 percent (according to World Bank data cited by this government paper). The corresponding figure for the European Union about 19 percent. Other countries that have lower ratio are Bangladesh and Pakistan, which also have the ratio at around 10%. The government’s endeavour should be to increase this to a higher level. For that, the government needs to widen the tax net by pruning the negative list that keeps certain services out of the purview of service tax and more importantly check evasion.

The government’s endeavour should be to increase tax-to-GDP ratio to a higher level; for that, tax net should be widened and evasion checked

Advertisement

End of Article

Written by FP Archives

see more

)

)

)

)

)

)

)

)

)