Subsidy is one expenditure that the governments in India find difficult to cut. It is understandable, considering 33 percent of the world’s poor live in India. Prime Minister Narendra Modi has time and again said that his government is for the poor in the country. The government did not even bat an eyelid while vetoing the global trade talks, where the rich nations insisted on capping India’s food subsidy. India’s action had antagonised the rich nations, but Modi held his ground. [caption id=“attachment_2118971” align=“alignleft” width=“380”]

Reuters[/caption] However, the government’s stance in the subsidy issue has been against the free market principles, which advocate drastic cuts in such expenditure. The key ingredients in India’s subsidy are fuel, fertiliser and food. While the government has already taken steps to reduce fuel subsidy by freeing petrol and diesel prices, the other two continue to be heavily subsidised. “We need to bring agricultural subsidies everywhere under discipline and to object to that for India is to believe that our agricultural sector will remain forever in need of price support. This defeatist assumption also was responsible for our dragging our feet on special protectionist safeguards for our agriculture earlier,” renowned economist Jagdish Bhagwati told Business Standard in an interview. He was reacting to a question on India’s stance on WTO talks. Those who argue against subsidies say that these are wasteful spending since they never reach the targeted group due to leakages in the system. It is the rich who are enjoying the benefits as lower priced food, fuel and fertiliser are diverted to them. That is the reason poverty is not getting eradicated though the subsidy spending is rising at a scorching pace, they say. A look at the graphics below shows their contention is true:

Reuters[/caption] However, the government’s stance in the subsidy issue has been against the free market principles, which advocate drastic cuts in such expenditure. The key ingredients in India’s subsidy are fuel, fertiliser and food. While the government has already taken steps to reduce fuel subsidy by freeing petrol and diesel prices, the other two continue to be heavily subsidised. “We need to bring agricultural subsidies everywhere under discipline and to object to that for India is to believe that our agricultural sector will remain forever in need of price support. This defeatist assumption also was responsible for our dragging our feet on special protectionist safeguards for our agriculture earlier,” renowned economist Jagdish Bhagwati told Business Standard in an interview. He was reacting to a question on India’s stance on WTO talks. Those who argue against subsidies say that these are wasteful spending since they never reach the targeted group due to leakages in the system. It is the rich who are enjoying the benefits as lower priced food, fuel and fertiliser are diverted to them. That is the reason poverty is not getting eradicated though the subsidy spending is rising at a scorching pace, they say. A look at the graphics below shows their contention is true:

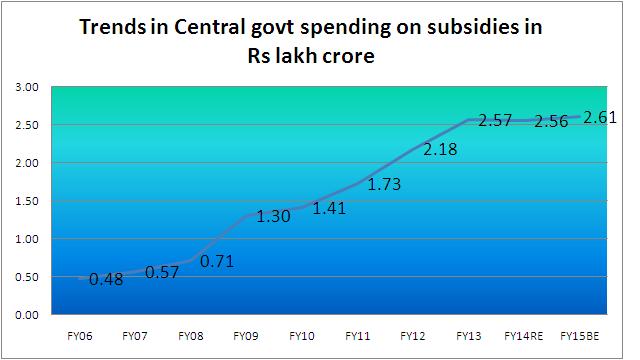

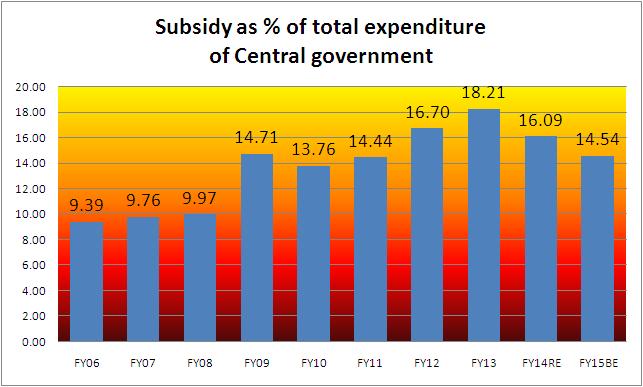

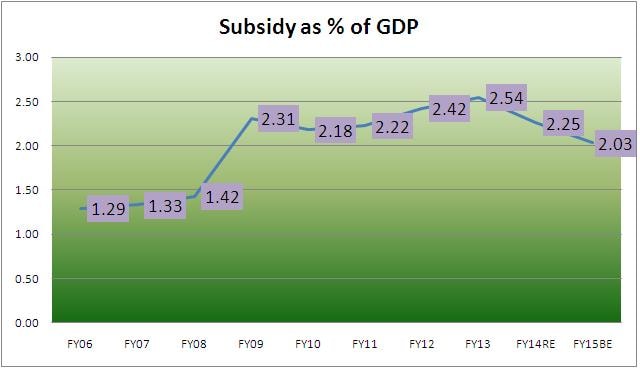

Over the last 10 years, subsidy pay out of the government has witnessed a steady increase from Rs 48,000 crore in FY06 to Rs 2.61 lakh crore (budget estimate) in 2014-15 - an annual increase of about 22 percent on an average. Subsidy as a percent of GDP also increased almost steadily from just 1.29 percent to 2 percent. But the figure is scarier when taken as a percent of total expenditure. In FY06, subsidies accounted for 9.4 percent of total government spending. This rose to a high of 18.2 percent in FY13. As per the revised estimates, this has declined to 16.09 percent in FY14. In FY15, it is likely to further fall to 14.54 percent of total expenditure, which is still uncomfortably high. However, the government is likely to be lucky enough see a drastic reduction in the subsidy due to the fall in global crude oil prices. A Reuters report quoting government sources has said that there could be a $8 billion reduction in subsidy burden. But even this cut will not help. That is because given the elbow room created by the low global crude oil prices, the government should reduce the burden more sharply. The only way out for the government will be widening the coverage of direct benefit transfer or DBT. The scheme rolled out by the erstwhile United Progressive Government aims to directly transfer the cash benefits into the beneficiary accounts linked to Aadhaar, thus plugging the leakages. The government has already introduced the scheme for cooking gas or LPG. It will have speed up the coverage of the scheme to include all cash benefit schemes. Data compiled by Kishor Kadam

Over the last 10 years, subsidy pay out of the government has witnessed a steady increase from Rs 48,000 crore in FY06 to Rs 2.61 lakh crore (budget estimate) in 2014-15 - an annual increase of about 22 percent on an average. Subsidy as a percent of GDP also increased almost steadily from just 1.29 percent to 2 percent. But the figure is scarier when taken as a percent of total expenditure. In FY06, subsidies accounted for 9.4 percent of total government spending. This rose to a high of 18.2 percent in FY13. As per the revised estimates, this has declined to 16.09 percent in FY14. In FY15, it is likely to further fall to 14.54 percent of total expenditure, which is still uncomfortably high. However, the government is likely to be lucky enough see a drastic reduction in the subsidy due to the fall in global crude oil prices. A Reuters report quoting government sources has said that there could be a $8 billion reduction in subsidy burden. But even this cut will not help. That is because given the elbow room created by the low global crude oil prices, the government should reduce the burden more sharply. The only way out for the government will be widening the coverage of direct benefit transfer or DBT. The scheme rolled out by the erstwhile United Progressive Government aims to directly transfer the cash benefits into the beneficiary accounts linked to Aadhaar, thus plugging the leakages. The government has already introduced the scheme for cooking gas or LPG. It will have speed up the coverage of the scheme to include all cash benefit schemes. Data compiled by Kishor Kadam

Budget 2015: Direct benefit transfer only way to cut govt's subsidy burden

FP Editors

• February 24, 2015, 18:55:53 IST

The only way out for the government will be widening the coverage of direct benefit transfer or DBT.

Advertisement

)

End of Article