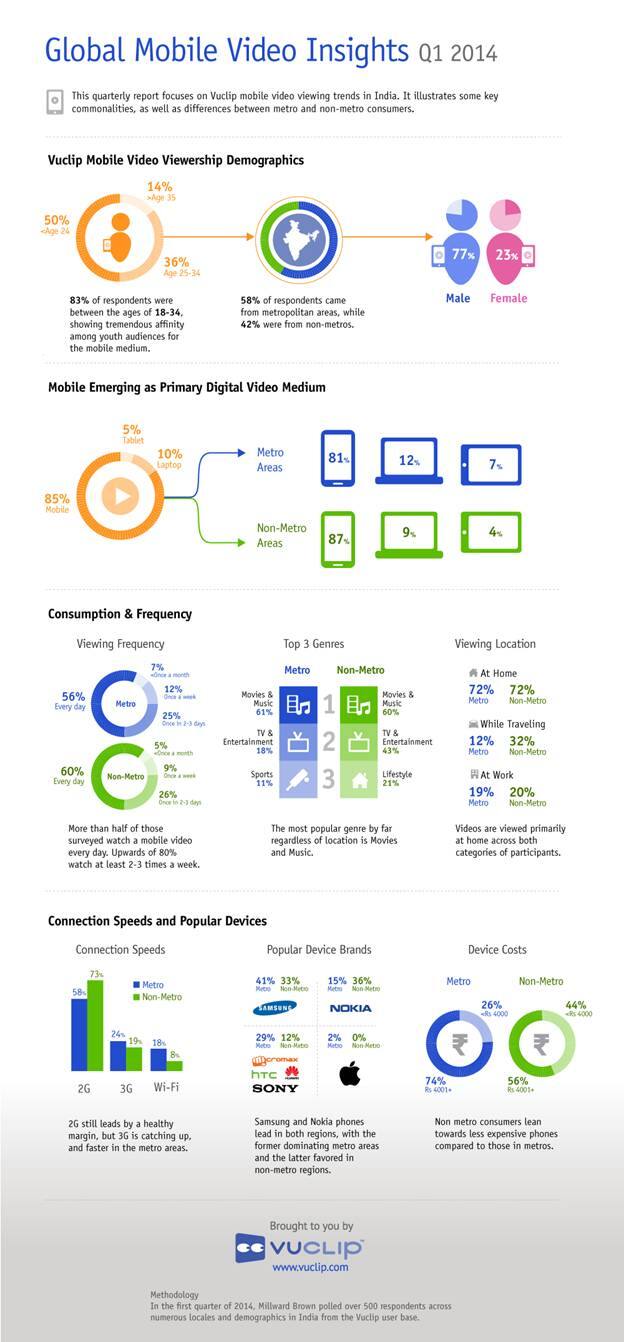

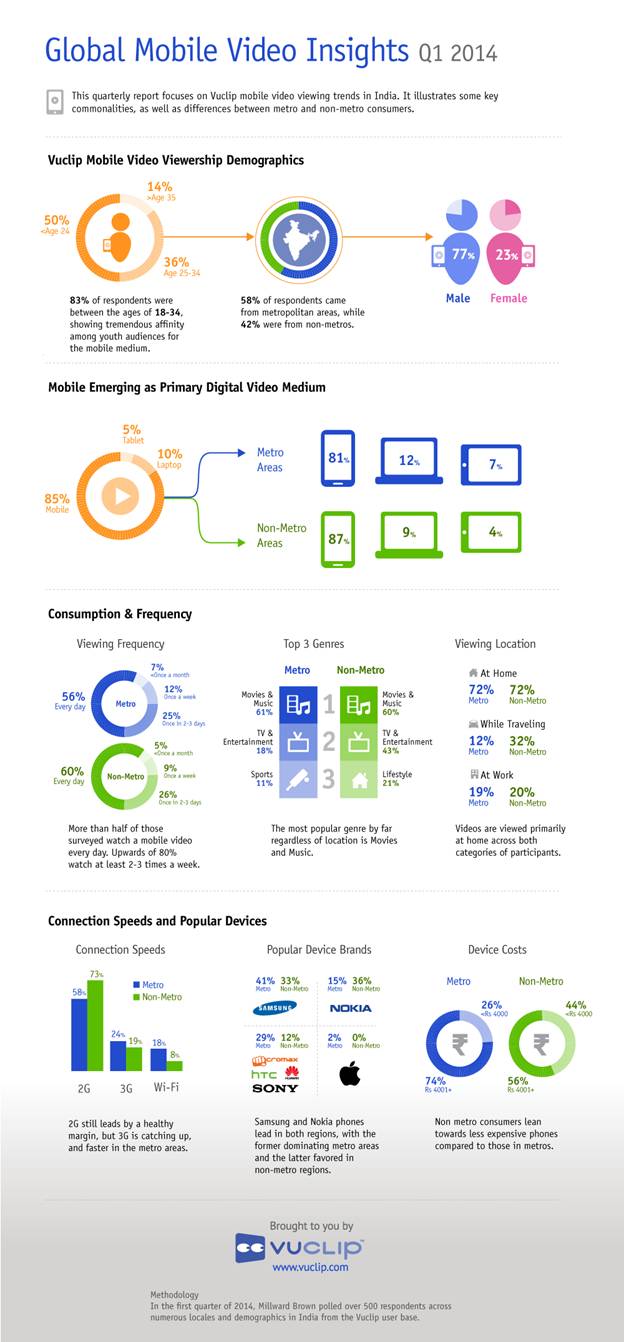

We live in an era of declining attention spans. So much so, that even the national pastime of watching television is making way for watch on-the-go entertainment on mobile phones phenomenon. Vuclip, the mobile video and media company, announced the results of a study of Vuclip’s user base conducted by global marketing and research firm Millward Brown. The study revealed that Vuclip’s more than 20 million mobile video consumers in India are largely trending towards mobile devices as their go-to source for content with 81 percent of metro and 87 percent of non-metro survey participants identifying mobile phones as a preferred medium. Moreover, 80 percent, an overwhelming majority, of Vuclip’s consumers report watching videos on their mobile devices at least once every 2-3 days, with more than half opting to watch daily.

The average adult will spend five hours and nine minutes a day online or consuming other types of digital media this year, an increase of 38 minutes or 16 per cent compared with 2012, according to new estimates from eMarketer. The amount of time spent watching TV is projected to fall by seven minutes to four hours and 31 minutes. Looking at the mobile phone as a strong alternative to traditional entertainment media like television, it is surprising to note 72 percent users surveyed regardless of region, watch videos from home. This, at a time, when television sets and a cable connection are ubiquitous in the most rural areas of the country too. The most popular genres among participants were movies and music, though in non-metro areas, the popularity of TV shows and lifestyle entertainment videos spikes. It’s notable that there is a growing interest in longer videos on mobile, with most metro users (59 percent) opting for videos over five minutes in length.

Connection Speeds and Popular Devices

The 2G internet connection is still the most widely used, making up 73 percent of non-metro and 58 percent of metro markets, although metro users report higher usage of 3G networks (24 percent versus 19 percent). Samsung and Nokia phones lead in both regions, with the former dominating metro areas and the latter favored among those polled in non-metro regions. In metros, 73 percent of consumers spend over Rs. 4000 (approximately $65 US) for their device where-as in non-metro areas, 44 percent of consumers favor phones priced less than Rs. 4000, explaining the dominance of Samsung & Nokia devices in metros and non-metros respectively.

Along with devices being sold, online ad shares will take a bite of the pie too. By 2016,

Forrester says, advertisers will spend almost $77 billion online

, comprising 35 percent of overall ad spending.

Within online advertising, however, lots of changes are ahead. According to Forrester mobile ads will overtake social ads and email marketing already this year: They’ll hit $8.2 billion in revenues by 2016 as advertisers will want to reach people while they’re on mobile phones and tablets.

)