With global retailers expanding their presence in India, organized retail supply in 2013 witnessed a strong year-on-year growth of about 78 percent, says a new report. While most of the retail supply in 2013 was concentrated across Tier II cities, 2014 is likely to witness supply addition in the key hubs of the National Capital Region (NCR) and Mumbai,according to real estate research firm CBRE’s latest report, India Retail Market View H2 2013.

The Foreign Investment Promotion Board has approved 12 proposals worth Rs 820 crore from retailers such as H&M, implying the current year will be a positive one for the retail sector.

Last year, prominent global players such as Starbucks, Krispy Kreme, Dunkin Donuts, Forever 21, Zara and Superdry expanded their presence across India’s leading cities during the second half of 2013. Brands such as Brook Brothers, Missoni, Michael Kors and Emilo Pucci from the luxury and bridge-to-luxury segments also made inroads into India.

Demand from global retailers in the Delhi NCR and Mumbai markets remained buoyant, as more retail groups sought space in prime shopping centers, as opposed to standalone high street outlets, says the report.

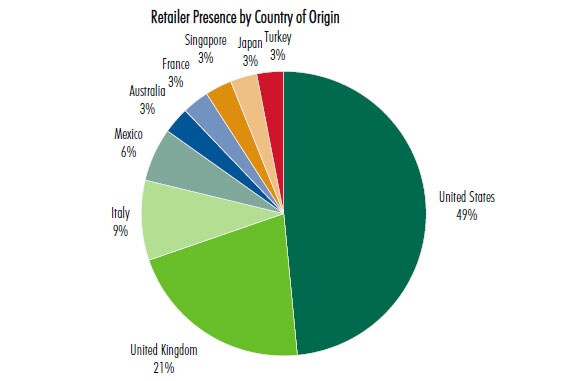

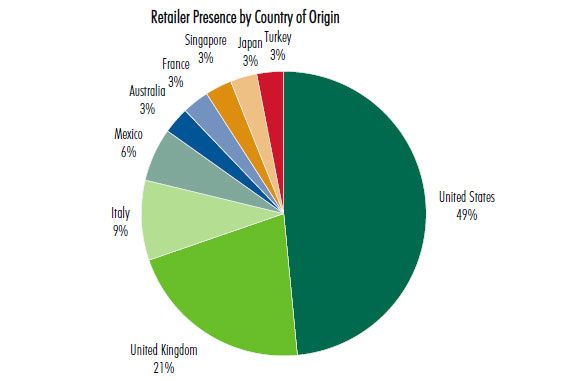

[caption id=“attachment_1355485” align=“aligncenter” width=“584”]

**The charts above represent presence of prominent global retailers in National Capital Region (NCR) and Mumbai in H2 2013. Source: CBRE[/caption]

**The charts above represent presence of prominent global retailers in National Capital Region (NCR) and Mumbai in H2 2013. Source: CBRE[/caption]

“Despite ongoing uncertainty, retail real estate witnessed good activity during 2013 with a number of international brands entering and expanding across key cities. 2014 is expected to remain positive for the retail sector, with existing brands expected to ramp up operations and new brands look to making their India entries,” saidAnshuman Magazine, Chairman and Managing Director of CBRE, South Asia Pvt. Ltd.

However, rental values displayed mixed trends across top cities. While traditional high street markets-such as Khan Market in Delhi and Brigade Road and Commercial Street in Bangalore-witnessed an increase in rental values, the shopping hubs of Eastern Mumbai and South Bangalore saw a decline.

Cities such as Hyderabad, Chennai and Kolkata largely witnessed stability in pricing while Pune saw an increase across its high streets, even as its mall rentals remained stable.

But the limited availability of quality retail space in core locations is likely to pose a greater barrier to new retailer entry in a number of key markets-including Delhi NCR, Mumbai and Bangalore-as opposed to prohibitive rentals.

)