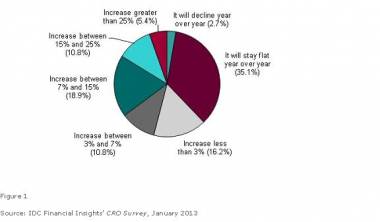

62 percent of Asia/Pacific banks expect rising technology budgets for risk management, with more than a third of risk professionals projecting at least a 7 percent increment in spending in 2013 and only a negligible 2.7 percent expecting weaker risk budgets in 2013 (See Figure 1). These are some of the highlights of a recent IDC Financial Insights survey polling 40 banking Chief Risk Officers (CROs) and their deputies from across 11 Asia/Pacific nations.

Q. Our institution’s CapEx and OpEx on risk management implementation for 2013 will grow by:

More insights are revealed in the report, “Business Strategy: Asia/Pacific CRO Survey — Risk Management in the “New Normal” Environment”, which sheds light on the organisations’ investment considerations and processes instituted for financial and enterprise risk management, and opinions on the role of risk vendors. This survey document also identifies respondents’ top enterprise risk initiatives for 2013 and presents executives at banks an opportunity to benchmark their risk management investments and strategies against those of fellow peers at an aggregate level.

“Changing global dynamics call for executives to astutely manage their risk profiles to ensure that their financial institutions not only survive but thrive in this ‘new normal’ environment - an environment where bankers have to deal with a climate of protracted slow growth and hyper competition. With various forces converging to push risk management into the consciousness of senior bankers across Asia/Pacific, we wanted to shed light on core risk initiatives and the associated business drivers,” remarked Li-May Chew, associate research director, Asia/Pacific Financial Advisory Service, IDC Financial Insights.

She added, “Our findings reveal that while capital remains precious, IT and risk offices at financial institutions are cognisant of the need to establish a fine balance between driving business strategies and enhancing risk management controls.”

According to Chew, banks in Asia/Pacific are investing on the following technologies, in order of importance:

credit analytics

enterprise data management

enterprise risk dashboards and reporting

“They are also investing in skilled risk management staff, which is becoming a rare commodity in Asia/Pacific these days, since all the tools are irrelevant without the right people to utilise and manage them.”

The survey further points to a surprisingly high 77.2 percent of respondents agreeing that risk management vendors could possibly (though not necessarily) provide a greater level of risk analytic ability than could be found internally and, as such, are increasingly open to outsourcing to risk management specialists.

Nonetheless, regional banks are not transitioning toward the utilisation of cloud-based risk solutions yet. While this trend is increasingly prevalent in other regions, only 30.8 percent of the surveyed are sufficiently comfortable to even consider this possibility at the present moment, citing data privacy and security regulations as core inhibitors.

“As banks across Asia/Pacific scramble to remain ahead of the risk management curve, plug gaps within their risk management framework, and exploit the disruptive third platform technologies of Big Data and analytics, cloud computing, social business, and mobility, 2013 will witness their CROs continuing to elevate risk management to a high strategic priority internally. Risk executives will further engage in new dialogues with the Chief Investment Officers to ensure that risk is integrated with all business technology decisions, seek out new tools for risk management to cope with the ‘new normal’ environment, and invest in programs to ensure that risk management skills, code of ethics, and compliance obligations are developed and understood across all strata of the institution.”

)